Contributed by: Aaron Chow

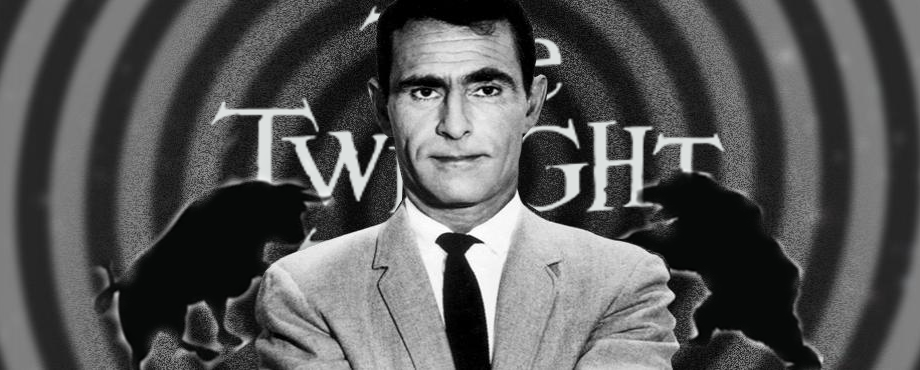

The BRB Bottomline: Whether you’re an institution or individual investor, Goldman Sachs or Post Malone, beware of Financial Twilight Zones.

Imagine a place where investors’ expectations about risk, profitability and growth are warped and markets stop functioning properly. These markets are not as uncommon as you might think. These are the Financial Twilight Zones.

Other articles in this column will teach you about basic valuation tools and heuristics, discounted cash flows and residual earnings, industry trends and market mechanics; but, before we can utilize any of this knowledge, we have to learn how to identify where—in which markets and market settings—will our hard work and time will be rewarded.

Trying to apply our skills in financial analysis to securities that do not exhibit a historical tendency to revert back to fundamental value within a reasonable time horizon is a futile exercise. Therefore, the most important tool in building a market-beating, long-term track record is to be able to identify and avoid markets that don’t reward financial analysis. That is, avoid Financial Twilight Zones.

Know Thyself and Thy Game

First a little background. Over the last 90 years, the U.S. stock market has created over $35T in wealth for investors; but, only 4% of the stocks in this time frame actually increased in value, according to a paper published in the Journal of Financial Economics by Professor Hendrick Bessembinder. The other 96% of companies either didn’t do much or permanently lost capital for their shareholders. Why does this matter to you?

Bessembinder’s research tells us four things about how you should approach investment strategy and analysis:

- If you’re in the business of finding stocks that will go up, success in the long-run will be a byproduct of meticulously avoiding the 96% of publicly-traded stocks with low barriers to entry and nonexistent competitive advantages.

- If you’re in the business of selling borrowed stocks in the hopes that they’ll go down—the technical term for this is shorting—success in the long-run will be a byproduct of both meticulously avoiding a market full of legitimate (though unremarkable) businesses and managing market risk as well as the various costs and risks of the short-selling business.

- If neither of these strategies suit your fancy, that’s fine. Buying the market through an S&P 500 index fund allows any investor to participate in the long-run economic returns of business without being an expert in financial analysis.

- However, if you think investing is interesting and want to give it a shot, you’ll need to equip yourself with some basic analytical tools. A prerequisite for succeeding in investment management is to build a framework from which you can identify investment-worthy businesses and—perhaps more importantly—avoid financial scams.

Building this framework won’t be easy. It’ll take time. More importantly, our tools for analyzing businesses and financial statements won’t translate into economic gains if we apply them in certain situations.

At this point, the stage is sufficiently set to introduce one of the most important concepts in financial analysis: Financial Twilight Zones.

Avoiding Financial Twilight Zones

One of Warren Buffet’s checklist items is to only invest in businesses that are within his circle of competence; but, beyond what any particular person understands, there’s a financial twilight zone where even professional investors don’t go.

In this financial twilight zone, investors’ expectations about risk, growth, and profitability are warped and markets stop functioning properly. The defining characteristic of these financial arenas are markets in which supply and demand for assets are structurally impaired.

For example, stocks of IPOs (companies that have just started trading on the stock market) have tremendous restrictions to trade that obscure pricing efficiency in the immediate aftermarket. Large investors cannot sell shares until an agreed-upon lockup date, investment bankers underwriting the stock are incentivized to push the stock higher to impress future clients, and short-sellers cannot borrow shares because most of the shares are still in private hands. Even if you found a company as unprofitable as Snap Inc. or Blue Apron, you couldn’t short the stock because much of the shares are in private hands for the first few months of trading (for more on the effect of short-sales constraints on the aftermarket pricing of IPOs see Berkeley-Haas Professor Panos Patatoukas’ paper here). Other instances of this imbalance occur in private equity as well as in real estate markets with limited development areas. Without natural sellers, prices and fundamental values can diverge and diverge significantly.

When professional investors are structurally excluded from a market, market misbehavior is rife.

These aren’t the only places where inexperienced investors can lose their shirts—losing money in normally-functioning markets is just as common; but, if we focus on why unknowing investors are prone to lose money in financial twilight zones, we come across some general advice on how to avoid permanent losses of capital.

A Personal Anecdote and Lessons

It doesn’t take much to figure out that something smells fishy.

Rich Uncles Investment Trust I (one) is a real estate investment trust (REIT) that advertises shares of its company on the radio and sells them to investors over its website. In December, the SEC (Securities and Exchange Committee) opened an investigation against Rich Uncles’ long-time auditor for abetting fraud. Moreover, the company hadn’t updated its net asset value (the equivalent of its share price) in six years and hadn’t disclosed any press releases—let alone material changes in the business—on its website since the fund’s inception. For investors in Rich Uncles,, their only point of communication with the company is its website!

While I’m no accounting genius or investing savant, after a week of solid research and documentation, I suggested to my friend that he unload his shares in the company. All I had to do was spend a couple hours a day reading through the company’s public documents filed on the SEC website. Doing this due diligence led me to uncover missing filings, aggressive reporting, and unsound business fundamentals. I found that the company was paying dividends by raising money from new investors, just like a Ponzi scheme.

While the case is a current one without any formal conclusion, I think it’s safe to say that I saved myself and my friend some money. And, if you believe Professor Bessembinder’s 4% rule, I think the opportunity cost saved is more valuable.

Rich Uncles operates in another area of the Financial Twilight Zone called non-exchange traded REITs. Non-exchange traded REITs are companies that sell shares to investors through non-exchange mediums like a website or on the phone. In an environment of historically-low interest rates and internet proliferation, electronic REITs or eREITs have spread all over the web.

While eREITs and other non-exchange traded REITs aren’t financial scams per se, they do exemplify the defining characteristics of a Financial Twilight Zone where supply and demand are constrained.

You can’t short an eREIT because there is no public market for them.

Most institutional investors couldn’t be bothered to purchase shares in a non-exchange traded REIT because their charters prevent them from investing in small and illiquid funds. Price discovery is slow if not nonexistent. All the power is with the managers of these non-exchange traded REITs. This is why material misstatements and unsavory business practices are so rife.

This is what the SEC has to say about non-traded REITs.

“Private REITS carry significant risk to investors. Not only are they unlisted, making them hard to value and trade, but they also generally are exempt from Securities Act registration. As such, private REITs are not subject to the same disclosure requirements as public non-traded REITs. Lack of a public trading market creates illiquidity and valuation complexities. As their name implies, non-traded REITs have no public trading market. Even if a liquidity event takes place, there is no guarantee that the value of your investment will have gone up—and it may go down or lose all its value.” – SEC Office of Investor Education and Advocacy

After reading this short excerpt, you’re probably wondering why anybody invests in non-exchange traded REITs. Still, non-traded REITs have raised over $30B within the last three years from individual investors, according to Robert A. Stanger & Co, an investment banking firm focused on real estate deals. You’re already ahead of the game.

A General Theory on Avoiding Losses

Though returns of particular stocks are unevenly distributed within the market, as Professor Bessembinder reports, the overall gains in the stock market are positively correlated with growth in business earnings and economic growth, which gives us several strategies for employing our financial analysis framework. However, these strategies are only effective if we employ them in situations where supply and demand are operating normally.

We only want to invest in companies that trade in markets where the recognition of value is reasonably relied upon. Otherwise, we can just as easily assume that the price will remain widely divergent from fundamental value, and our financial analysis would be for nought.

Thus, the most important tool that we have as investors is the ability to avoid markets where the odds are stacked against us and to choose the playing field that plays to our strengths.

Take Home Points

The most important prerequisite for long-term, market-beating investment returns is choosing the markets that reward financial information analysis and avoid Financial Twilight Zones (such as speculative IPOs that are prone to overpricing, non-exchange traded REITs, etc.) where supply and demand are skewed.