Author: Kaylee Morgan, Graphics: Walton Bullard

The BRB Bottomline:

A successful middle ground for your money. As inflation continues its upwards hike, savvy consumers can respond to the increased interest rates by shopping for a better savings account option.

Investment 101

Low risk and high reward. That’s the dream for investments, right? It’s easy to get caught up by the stock market and its vast expanse of opportunity for investment — which comes with the intimidating risk of losing money. Oftentimes, it’s simpler to plant savings in a regular bank account, earning a meager few cents every month on interest. With current interest rates, the earnings accrued from depositing $1,000 into the average savings account for one year would amount to a whopping $3.51. Choosing this option for savings is a conscious decision to forego additional streams of, albeit riskier, income. While it’s easy to take the passive route with savings in an attempt to avoid the high risk of investing (as well as the time it takes to become knowledgeable about investing in the first place), it’s important to be aware of all the available options for passive income. A successful middle ground can be discovered by doing some “interest rate shopping,” providing a hands-off approach of earning more money through a higher annual percentage yield (APY).

To get a holistic understanding of interest rates, learning about the Fed is essential, as it has a significant impact on these rates. The Fed is the central banking system in the United States that determines interest rates, manages money supply, and regulates financial markets, and is the most powerful financial institution in the U.S. In our current inflationary environment, the Fed has been issuing a series of hawkish interest rate hikes in order to combat inflation, causing many economists to fear an imminent recession, or hard landing. But what does it actually mean for the Fed to raise interest rates? In essence, the interest rate that is being hiked is the rate commercial banks charge each other for short term (overnight) loans, called the Federal Funds Rate. As this rate increases, it becomes more expensive for banks to take out loans, which reduces demand for borrowing money. With less demand for borrowing money, people are more incentivized to save money. This increase in savings reduces how much money is in circulation and thus ultimately lowers inflation.

While this process makes sense in theory, it may be hard to understand how rising interest rates affect the typical consumer. Interest rates have a direct impact on financial markets and their subsequent asset classes; they also affect mortgages, credit cards, and various loans, including student and auto loans — which is what consumers often face on a regular basis.

Consumer Options

Consumers can actually benefit from rising interest rates in an incredibly simple way: by putting their money in alternative savings accounts. This seemingly unassuming strategy provides passive income without directly investing money in volatile markets — equating to stable and safe returns, and with very little risk.

There are four major types of accounts that allow consumers to store savings with higher APYs than that of the average savings account, which as of February 21, 2023, the FDIC reports to be 0.35%. While the following is not an exhaustive list, these are four of the more common alternative accounts.

High Yield Savings Accounts

As its name suggests, a high yield savings account is just like a regular savings account — except it offers a higher interest rate. Oftentimes, a consumer’s usual bank has a high yield savings account option, such as Capital One and PNC. This means that these accounts are also Federal Deposit Insurance Corporation (FDIC) insured. These accounts, however, typically have a variable APY, which means the interest rate fluctuates with the market. The variable APY could be beneficial when interest rates are high, but can be unpredictable and potentially disappointing as the market changes. In terms of use cases, high yield savings accounts are a great place to keep an emergency fund. They provide earnings on money that likely won’t be needed in the near future, but also allows margin for quick liquidation in the event of an emergency.

Money Market Accounts

These accounts function as hybrid savings and checking accounts. In addition to providing higher interest rates than a checking account, money market accounts often come with a debit card and check-writing abilities. These features provide the best of both worlds when it comes to liquidation of savings. One of the major drawbacks and potential barriers to entry to opening a money market account is the higher minimum balance required relative to regular savings accounts. If that minimum balance is not met, fees are often charged. Money market accounts also have a withdrawal limit of six times per month, equating to less liquidity compared to alternative types of accounts. This account is great to help work towards a savings goal — such as a wedding, a down payment on a house, or a smaller but still substantial purchase like new furniture or a new computer. It can also be great for vacation savings as the debit card allows for easy spending.

Cash Management Accounts

These accounts function almost identically to money market accounts, but with one key difference: they are managed by non-bank financial institutions. These institutions include entities such as brokerages and robo-advisors. As a result, cash management accounts typically don’t restrict the number of transactions or withdrawals their customers can make per month, meaning higher liquidity is offered. They also tend to have lower fees and minimums than do money market accounts. Additionally, cash management accounts can be linked to a brokerage or investment account, making them a great option for the already savvy investor. On the flip side, it is important to still look out for hidden fees with these accounts, such as a minimum balance fee or a monthly maintenance fee.

Certificate of Deposits

Certificates of deposit (CDs) behave similarly to bonds in that they are time deposit accounts. Just like with bonds, in the short term, the user agrees to earn a fixed amount of interest for a fixed amount of time on the money they invest. They receive their principal amount of money back, along with the interest accrued, at the time of maturity. CDs can be a great option for savings, but just like bonds, these accounts are more affected by inflation than are other options. Bonds and CDs generally become less attractive with higher inflation because of the corresponding decrease in real return. Usually, this rule of thumb applies more heavily to investments with maturities of ten years or longer, meaning CDs with shorter maturities are typically less risky in terms of inflationary effects. For CDs, it is possible to access the money earlier than the maturity date dictated by the original contract, at the cost of an early withdrawal fee. Because CDs have the lowest amount of liquidity, they tend to pay the highest interest rates to compensate. The longer money is left in the account, the more it tends to earn, up to about a year. This type of account is great for a savings goal that will be spent in a year, such as a vacation planned 12 months in advance.

How much would $1000 earn after 1 year, compounding daily?

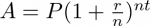

Here’s a run down on how to do the calculations:

- Calculate daily interest rate by dividing APY by number of days in the year

- Plug into the compound interest formula below

using the following variables:

- A = final amount

- P = principal amount (original amount deposited)

- r = interest rate

- n = number of times interest is applied per month

- t = number of time periods

| Account type | Average interest rate | Best interest rate (Forbes) | Average earnings | Best earnings |

| Regular Savings | 0.35% | N/A | $1003.51 | N/A |

| High Yield Savings | 0.6% | 4.28% | $1006 | $1043.95 |

| Money Market | 0.48% | 4.4% | $1004.84 | $1045.13 |

| Cash Management | 1% | 4.28% | $1010 | $1043.95 |

| Certificate of Deposit (1 year) | 1.36% | 4.56% | $1013.63 | $1046.28 |

Conclusion

Each of these options has similar strengths. They are all low-risk ways to earn passive income and offer higher APYs than the average savings account. However, each type of account also has unique attributes that make it better suited for certain consumers, depending on their savings needs. Once an account type has been selected, there are several factors which go into choosing the specific financial institution. These include the initial deposit amount, minimum balance requirement, hidden fees, compounding frequency, and whether it has a variable APY.

As inflation continues to persist, savvy consumers can respond to high interest rates by shopping for better savings account options. Protected from the variability of investing in the stock market, these accounts can provide a safe alternative for savings without allowing them to sit idly, losing value to inflation.

Take-Home Points

- The Fed is raising interest rates to combat inflation.

- Consumers can take advantage of this by relocating their savings to a greater interest earning account.

- High yield savings accounts give higher earnings and are often offered by a bank the consumer already banks with.

- Money market accounts give debit cards and check-writing abilities.

- Cash management accounts are the same as money market accounts, but are run by non-bank financial institutions, meaning they have lower fees.

- Certificates of deposit act most similarly to investments: the consumer agrees to deposit their money for a given amount of time, earning higher interest the longer they leave it (up to a year).

It is really a great and useful piece of info. I’m satisfied

that you just shared this useful info with us.

Please stay us informed like this. Thanks for sharing.