BRB Bottomline: Unicorns – the venture capital backed startups that graze throughout Silicon Valley – were once an endangered species. However, this year they have begun to appear everywhere with a record number of companies filing for an Initial Public Offering (IPO). The leader of the pack is Uber Technologies –with a valuation of $120B and roughly 58% of the ridesharing market – followed by a slew of industry leaders such as Lyft, Slack, Pinterest, Postmates, and Zoom. All of these unicorns are flying into the stratosphere with record breaking valuations and 2019 could prove to be the biggest year on record for the amount of money raised by U.S. listed IPOs.

In order to better understand some of the reasons why these companies are opting for the public markets let’s take a look at Spotify – one of the biggest IPOs of 2018 and a fellow unicorn.

Spotify Direct Listing

The company didn’t need to raise any additional capital as the largest Venture Capital firms were continuously pumping money into it to fuel its growth. However, Spotify was interested in enabling shareholders of the company, early investors and employees, to sell their shares. As it took off and began to grow at breakneck speeds, the company attracted numerous angel investors, small VC firms, and eventually the titans of Silicon Valley – driving up valuations and excitement.

From the perspective of a VC firm, each round of funding that it partakes in makes its portfolio increasingly reliant on the unicorn. Most VC firms operate with the 2% and 20% rule, which basically means devoting 20% of their profits to their LPs and only 2% of their profits towards management. This is why VC firms are very lean, rarely hire new employees and meticulously planevery expense in the next 4-5 years. Therefore, the main goal of a VC firm is to guide the startup in reaching a size and valuation where an accriaution, IPO, or other liquidation event occurs. The problem, however, arises when companies choose to stay private, seeking increasing amounts VC funding. The buy in for firms increases too and only the largest funds, such as the SoftBank Vision Fund, are able to inject the necessary amounts of capital. To learn more about how the Vision Fund is changing the VC industry, read Joseph Ng’s article.

Lyft Leads the Way

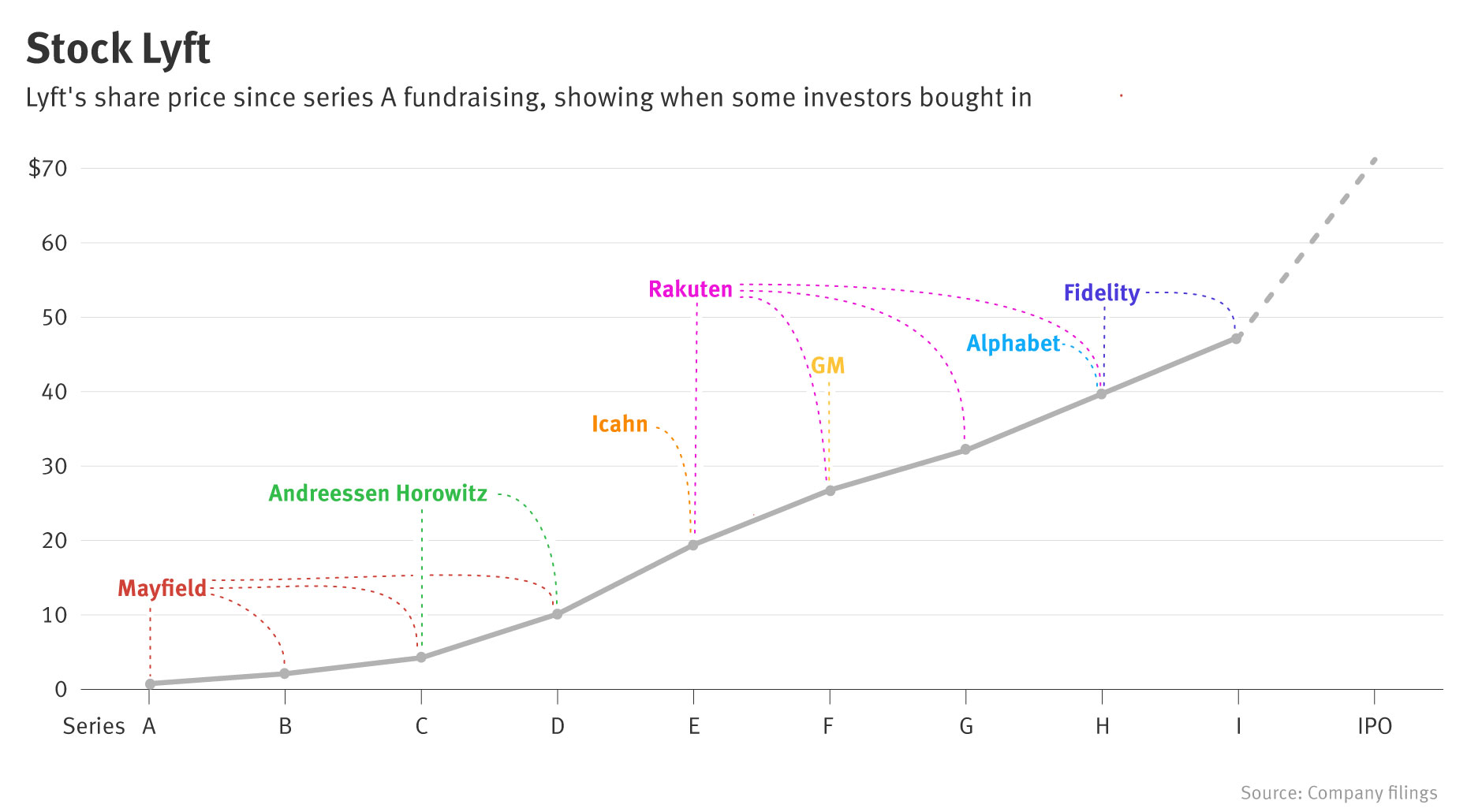

Lyft was the first to go public this year, beating Uber and setting the pace for the other unicorns to follow. It took the company and investors 12 years to reach this momentous stage. Some of Lyft’s early VC investors, such as Founders Fund and Third Point, sold their holdings early and missed out on the astronomical returns. However, many other investors, including larger investors, such as Andreessen Horowitz and Rakuten not only continually held onto their holdings but also doubled down.

To give a sense on the return some of these investors are looking at, Manu Kumar, the founding partner of K9 Ventures which invested in the seed and Series A for Lyft (called Zimride back then), is expected to earn more than $36 million from his $350,000 initial investment made nine years ago. This shows why VC firms focus on reaching a liquidation event and maintaining their equity in such high-growth juggernauts.

However, all good things must come to an end. More often than not, VC firms and company’s leadership switch their sights onto new opportunities and begin to pressurise the company into issuing and IPO to achieve liquidation. Thus,companies such as Uber and Slack can remain private only for a finite amount of time.

This phenomenon is encapsulated by the story of a whale who grew up in a lake. As it grew bigger the space available for it to explore in the lake continually decreased and eventually it outgrew the lake. The lack of space, food, and ability to grow hindered the whale’s wellbeing. These unicorns, similarly, have outgrown the private markets and need to expand into the vast public markets if they hope to continue growing and disrupting their respective sectors.

While silicon valley unicorns, such as UBER and AirBnb, continue to grow and cement their global importance – incurring an increasing slough of challenges – their inherent goals and objectives have not changed. Like most other companies, these unicorns, have two main goals: appeasing investors and increasing market share. Conversely, the venture capital firms that have funded some of these unicorns for over a decade have different goals and thus push private companies into going public to recuperate their money. However, companies would not go public solely based on their investors’ wishes; there needs to be some other benefits of going public.. So what are these benefits?

Why Go Public Now?

In business, the bottom line of profitability is constantly emphasized by investors and other players in the stock market. Conventionally,, profitability is associated with success. However, unicorns focus on growth – even prioritising it above profitability. Surprisingly, venture capital firms have fully enabled this trend by funding unicorns regardless of huge losses. So why go public where profitability is forced to the forefront with increased public and regulatory scrutiny? IPOs give companies the ability to increase their market share – the second main goal – by increasing brand awareness, trust and access to more money.

Unicorns are still focused on growth and the current IPOs provide them with the opportunity to grow by enhancing their brand and gaining much needed new investors. To better understand this idea, let’s look at one of the most iconic examples – of Uber and Lyft. As Recode reporter Theodore Schleifer points out these two giants rushing to go public is not an accident, but highly strategic. Lyft needed to bolster its recognition and step out of Uber’s shadow;going public is perfect vehicle to do so by creating a buzz in financial and consumer circles. Uber, on the hand, needed re-develop its brand after numerous sexual assault charges from passengers, allegations of corporate discrimination and regulatory avoidance. These two mega giants, thus used IPOs as a means to oust their competitors by increasing trust in their businesses and redeveloping their brand images.

However, more importantly, an IPO is a way for companies to gain funding, which usually is utilized to help the company grow.. In the attempt for diversification, mitigating risk, and recuperating investment, venture capital firms pressurise unicorns into going public; in tandem, the companies themselves reduce reliance on VCs for funding. The process of VC funding for even gigantic companies like Uber, who have reliable and institutionalized investors, is still time consuming and onerous. Furthermore, while Uber’s ability to raise a billion dollars in funding may seem shocking for outsiders, for Uber to continue to grow, they need to be able to raise even more money. The venture capital space is only so large and eventually a large, well known, and arguably highly successful unicorn company like Uber will outgrow private funding. While the venture capital market is flush with funds, it is not large enough to sustain some companies, and the only market larger than venture capital is the public market.

Take Home Points

The public market provides unicorn companies the ability to gain access to a vast amount of cash without loss of control since the distributed equity tends to be in the form of common stock rather than preferred stock, usually given to venture capital firms. Thus, while it might seem like an IPO decreases autonomy due to increased scrutiny, it increases autonomy by diversifying control and decision-making power. Thus, by going public, both venture capital firms and highly valued private companies achieve their goals. VCs get their money back and unicorns continue to grow. These unicorns are now whales in a pond, and it’s time they swam free in the ocean.