BRB Bottomline: Robinhood has taken the world of stock trading by storm. In a market that was previously inaccessible to a majority of the population due to brokerage fees and other underlying costs, Robinhood comes as a breath of fresh air for the average investor. The app offers the opportunity to trade ETFs and Securities in the US market, free of charge. Having racked up almost 5 million users and a valuation of more than $5 billion, Robinhood seems to be a harbinger of stock market democratization. But does democratization simply mean gaining access to markets? Are there any potential downsides to an application like Robinhood? And how does it fit into the overarching conversation of financial democratization in other domains, such as Venture Capital?

Robinhood’s Impact on Fees

Robinhood’s success story has prompted other major financial service companies to take note and, in some cases, alter their traditional services to meet changing demands. For example, JP Morgan came out with its own online application for low-cost trading. The application, called “You Invest,” offers access to JP Morgan market analyses and currently provides 100 commission-free trades, after which trades are charged at a heavily discounted rate. Several other traditional brokerages, such as Charles Schwab and E*Trade slashed their commission rates by over 35%. Robinhood has accelerated a race-to-the-bottom in fees for the financial services industry.

This sort of shake-up has been a long-time coming. The capacity to reduce commission rates has been available for many years now, yet rates have been artificially high, because of tacitly colluding firms. Robinhood helps reduce the monopoly power of traditional brokerage firms that have charged exorbitant rates, hence bringing rates for the whole market down. (for example, JP Morgan used to charge $25 per trade as recently as last year compared to $2.95 on its online application today)

However, certain investors prefer paying a premium for conventional brokerage services such as risk management, risk advising, access to superior charts and analysis and so on. Robinhood currently lacks these services, and unless it comes up with a method to do so, traditional brokerage firms may continue to enjoy significant demand. Essentially, Robinhood offers little to no value to the professional investor but opens doors for a growing population of inexperienced (and often young) investors, who can now start with just a few hundred dollars. This democratization has both positive and negative implications.

The Downsides?

Robinhood’s mission statement is “to democratize access to the American financial system,” which they say is the core ideology behind their zero commission rates. The app has given thousands of new investors access to financial markets, in turn increasing overall trade volume as well, more so because inexperienced investors tend to trade more frequently as opposed to holding stocks for long periods of time.

This increase in trade frequency has potential downsides for investors. Investors that do not trade based on company fundamentals are very likely to sell their stock at the slightest hint of price fluctuation. This prevents investors from moving from the short-term capital gains tax rate, which is the same as your income tax rate to the long term capital gains bracket, which has a much lower rate.

Trading frequently also means investors can lose out on potentially grade trades. Stocks generally tend to perform better over the long run, and investors that stay invested in the long run enjoy the effects of compounding. For example, take a stock that experiences price fluctuations in the short run but grows annually at a rate of 20%. If you invested $100 in Year 1 in the stock, you would have $120 in Year 2 and $144 in Year 3 – increasing returns with time! The amateur Robinhood investor is likely to miss out on this opportunity because he/she had sold the stock due to the price fluctuation instead of holding it.

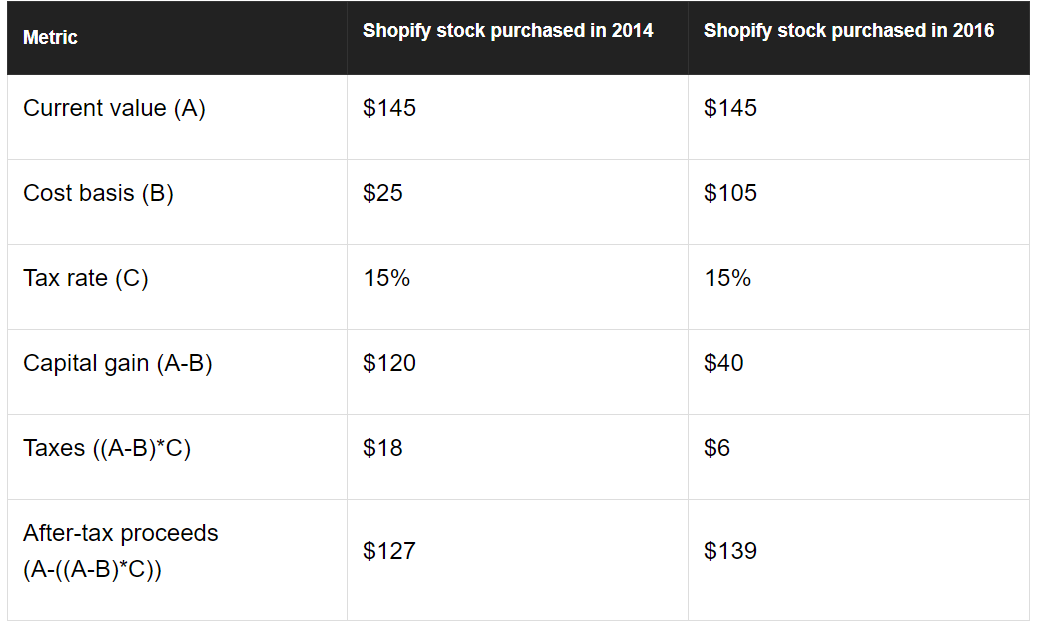

Thirdly, Robinhood has potential disadvantages even for investors that decide to hold a stock for a long period of time. The Motley Fool explains how a Robinhood investor can end up losing money due to higher long term capital gains taxes. In the Shopify example below, selling the stock purchased in 2014 entails higher taxes because the value of the capital gain is higher.

While most conventional brokers allow you to choose which lot to sell, Robinhood doesn’t – the stock you bought in the first lot is always the one sold first, no questions asked. This is known as the FIFO method. Although selling the earliest lot means that you have a higher chance of being in the long-term

capitals gain bracket (which has a lower rate than the short-term tax), it may also end up in higher capital gains taxes for this category of investors.

These are only some examples of how an investor on Robinhood can actually lose most of, if not all the money they save by not paying commissions on the application. So, while the zero-commission rate attracts hordes of new investors to the market, the flipside is that many of these investors are inexperienced, hampering their ability to gain from market-access.

Just Another Wave of the Democratization of Financial Access

While Robinhood may be the current “big thing” in the democratization of financial access, democratization itself in finance has been a continuous process in the US. In his paper, “The Democratization of America’s Capital Markets,” John Duca notes that the first major shift in how investors accessed capital markets was during the 1970s and 80s, due to the rise of mutual funds. From 1975 to 1999, the share of household financial assets parked in mutual funds rose from 22% to 49%. Duca includes other explanations for why this democratization occurred, including declining mutual fund costs, the introduction of Individual Retirement Accounts (IRAs), and greater popular awareness.

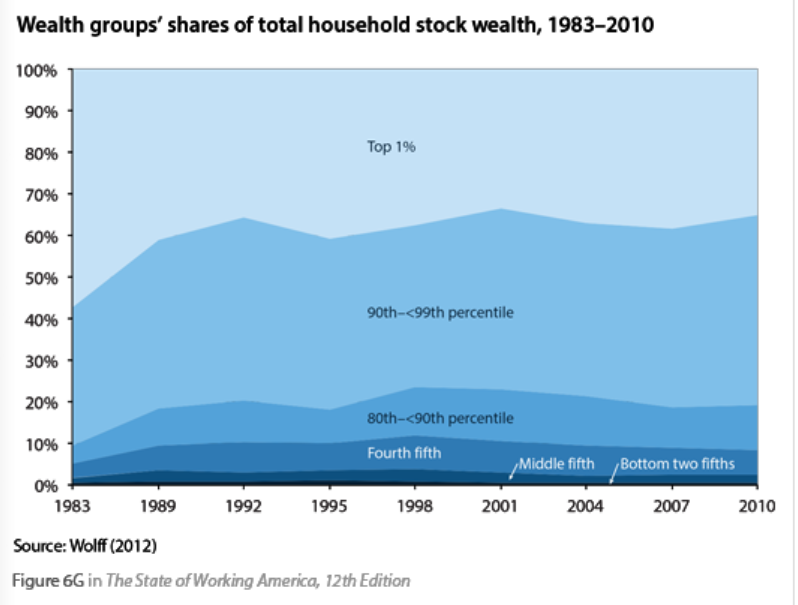

However, since the 90s, the top quintile of the population has held more than 90% of stock wealth, a trend that still persists today. While the percentage of households investing in the stock market has certainly increased due to Mutual Funds, ETFs, 401(k) funds and so on, overall wealth distribution has seen very slight changes.

It is hard to pinpoint an exact reason, but a major issue seems to be the massive disparity in the playing field. Institutional investors are far more equipped than the average investor to make returns in the stock market – they have access to better funds that perform better than the market. This isn’t the case for the average investor: most mutual funds, especially those offered in 401(k) plans, underperform the market. Moreover, investors are unaware that there are tools that could potentially bring in more wealth than these mutual funds. (for example, Index funds) The general lack of information on the amateur side is the “missing link” that leads to poor decision-making,resulting in poor wealth management.

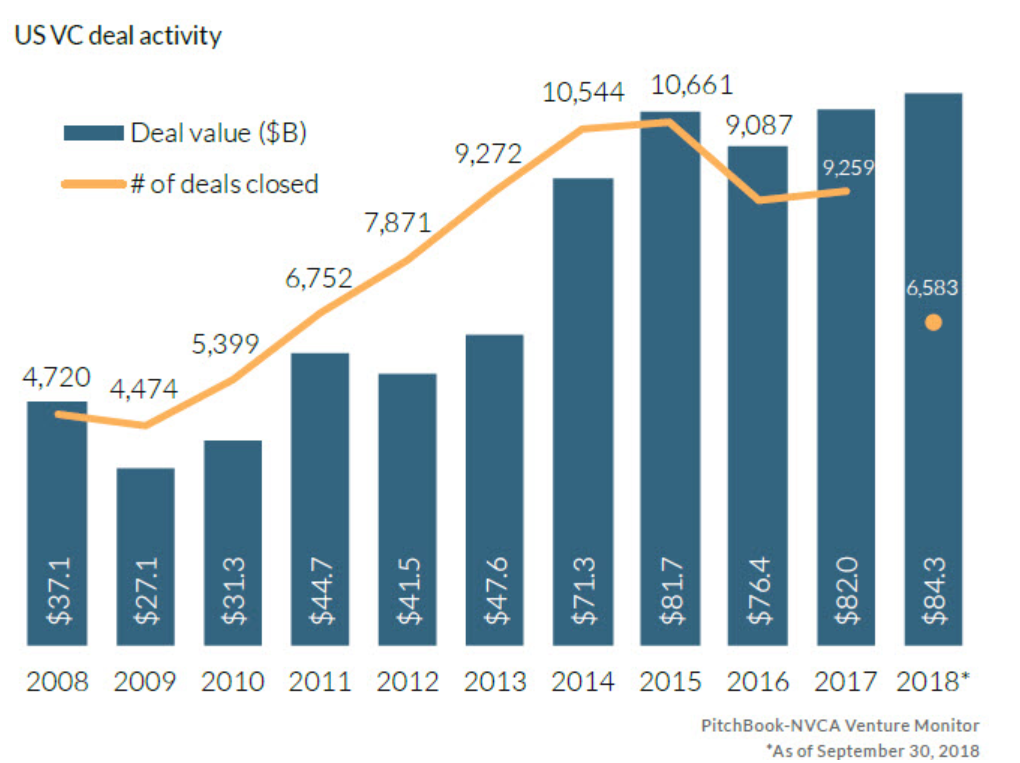

This concept of the “missing link” can be applied to the startup space as well. In recent years, there has been a massive increase in Venture Capital and private equity transactions. There has been a steady growth in VC funding this past decade, and the advent of Masayoshi Son (read Joseph Ng’s thorough article on the man himself!) and other billionaire investors has only added to the boom. All this means that It has become easier (on average) for startups to raise capital. This is illustrated below.

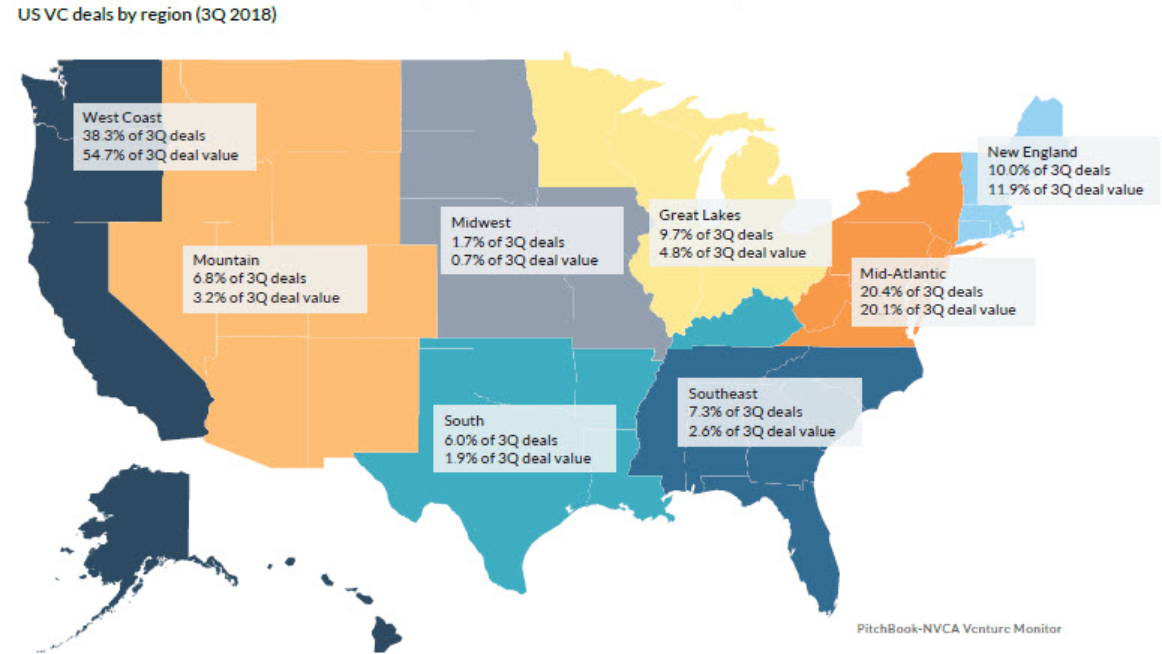

More than 50% of total deal value and almost 40% of all VC transactions in 2018 happened on the West Coast. This means that acquiring seed-funding is much harder for someone in the Midwest, than someone in say, the Bay Area. The concentration of funds within a few states acts as a barrier to entry for startups in other parts of the country.

While exposure to newer, sophisticated financial instruments has certainly increased (in terms of volume), there are certain missing links that have prevented this exposure from becoming ubiquitous. For example, venture capital remains a relationship game with the process of raising money still as opaque and inefficient as ever.

Take Home Points

Democratization is never solely about volume – number of mutual fund investments or amount of VC spending. One has to consider the missing links as well, such as geography in the case of Venture Capital, or financial literacy in the case of the stock market . While applications like Robinhood are certainly moving in the right direction by reducing the frictional costs to trading, without a commensurate increase in financial literacy, the investor merely has an additional avenue to gamble away their savings rather than an opportunity to create a better standard of living for themselves and their families.

Helpful Links:

https://www.epi.org/publication/wealth-stock-market-holdings/

https://www.dallasfed.org/~/media/documents/research/efr/2001/efr0102b.pdf

https://pitchbook.com/news/articles/the-state-of-us-venture-capital-activity-in-15-charts

https://www.fool.com/investing/2018/05/20/robinhood-the-high-price-of-free-stock-trades.aspx