BRB Bottomline: With minimal effort and a bit of financial discipline, purchasing shares of an index fund consistently over a lifetime can be the easiest and most effective way of accumulating wealth. But, if making money is so simple, why aren’t more people investing this way? Fund managers, financial advisors, and other financial experts, with a fiduciary duty to “help” you, charge absurd and unnecessary fees behind your back for their services, which they recommend because, while it isn’t necessarily in your interest, it is in theirs; however, with the right financial acumen, it can become easy to avoid these common pitfalls and begin to grow your wealth.

The Easiest Way to Get Rich

Imagine getting your first paycheck. After taking care of your school fees and buying a few bubble teas here and there, you might have some leftover money. Everyone treats their residual income differently: some think about depositing it into a savings account, some are tempted to spend it all, and some may choose to do a combination of the two.

However, money masters like Warren Buffett (the CEO of Berkshire Hathaway and one of the best investors to have ever lived), Jack Bogle (the founder of Vanguard, the first company to offer indexed mutual funds to its clients), and others of their ilk preach that investing in index funds is the common person’s best option for building wealth over the long-run. This idea combined with the strategy of dollar-cost averaging, i.e., systematically investing a portion of your savings over time with the goal of smoothing out the market’s inherent volatility, is a superior method of accumulating wealth and probably your safest bet at stockpiling a nest egg.

Here’s a real-life example: Let’s suppose that you start saving right now. You do this by not buying that $3.50 coffee you always get every morning on your way to class. If you start doing this at the beginning of next month, you will have roughly $100 by the end of that month.

Here’s where the investing comes in: instead of spending your savings, you invest that $100 into a S&P 500 index fund, which tracks and grows over time in tandem with the value of all of corporate America. The next month, you do the exact same thing: skip the coffee, save $100 a month, and invest that into the same index fund you invested into last month.

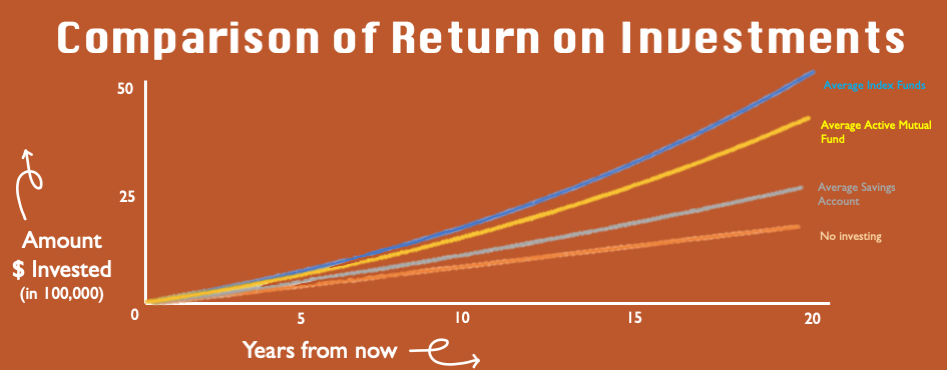

We did the math so you didn’t have to. If you were to continue this strategy, by the end of 5-years, you would have put in a total of $6,000 and would have earned $1,011.89 in market gains. At the end of 10-years, you would have put in $12,000 and would have earned $4469.87, and at the end of 20-years, you would have put in $24,000 and would have earned $22,435.11. But, that’s not all. These numbers assume a very conservative 0.5% return per month or 6% return per year.

In addition to that, these numbers also assume that you are not reinvesting the dividends—the sum of money regularly issued by companies to shareholders—you earn from the index fund, something that would add 1-2% in compounding per year. Over the course of 20-years, you stand to make a substantial amount of money.

Why Not Other Approaches?

You may question how Warren Buffett, Jack Bogle, and others can be so sure that “know-nothing” investors will earn this much if they dollar-cost average into index funds. Isn’t the stock market risky? Is this financial investment strategy guaranteed to make money? The simple answers are yes and no, respectively. Investing is risky and nothing about it is guaranteed. In fact, anybody who guarantees a result in any financial investment instrument shouldn’t be trusted. However, the promises about dollar-cost averaging into index funds over a lifetime are as close as to a certainty in the world of finance as you can probably get.

Index funds are funds whose portfolios are structured to match market indices (i.e. S&P 500 and DJIA). Historically, index funds have produced, on average, higher returns than the 6% yearly used in the example above. To be precise, the Vanguard 500 Index Admiral Shares (VFIAX) fund has returned 9.22%, 8.46%, and 13.10% for 3 years, 5 years, and 10 years respectively. Since its inception in 2000, the fund has produced 5.51% average annual returns calculated from the top of the tech bubble, which is promising considering the stock market underwent two financial crises since then.

Index funds essentially own a share of every business listed on the U.S. stock exchanges. Therefore, if the market does well, so does the index fund. Index funds can’t outperform the market because they are the market, but, importantly, the only way for the index fund to perform poorly is if the entirety of the market is performing poorly. Such a case is, logically speaking, quite unlikely or at least more unlikely than a single business going under. Even more unlikely is that corporate America does poorly over periods longer than 3-5 years. Index funds also provide the investor a broad exposure to risk, which in turn increases the chance of profiting on growing industries, while simultaneously decreases the chance of losing with an underperforming one.

The safest advice when investing in the stock market is to keep your portfolio diversified. Well, Burton Malkiel, Princeton Economics professor and author of A Random Walk Down Wall Street, argues the best way to do so is to own an index fund. For one, index funds have plenty of exposure to foreign markets. Roughly 24% of the revenues incurred by an S&P 500 index fund derive from overseas sources. Index funds are also exposed to commodities with businesses such as Anadarko Petroleum Corp, Cabot Oil & Gas, and Peabody Energy.

How about diversification of risk related to capital structure? While buying the S&P 500 only gives you exposure to equity ownership in businesses, you can envision some revenue diversification in the sense that almost 15% of the S&P 500 is comprised of financial services companies, which see their revenues coming from debt-structured products. The S&P 500 index fund includes companies such as Bank of America, which has $937 billion worth of loans on its balance sheet as of December 31, 2018, and Apple, which owned $245 billion in marketable securities (treasury bonds, certificates of deposit, money market funds, etc.) as of December 29, 2018.

Vanguard: The Model Mutual Fund

With hundreds of mutual funds available, there is only one that can be recognized as the “true mutual fund”. Vanguard, founded by the late Jack Bogle, is owned by its investors and doesn’t spend money on advertising in order to lower expenses. Relative to other funds, Vanguard’s annual expense ratio is the lowest among its industry peers due to its aggressive focus on reducing costs. Not to mention, Vanguard index funds beat 90% of actively managed mutual funds. Vanguard’s investor oriented operating strategy and “pro-consumer” organization structure was a maverick of its time and continues to be a model for maximizing investment returns.

Why Aren’t People Doing This?

Despite the fact that many people are saving through employer-sponsored 401(k) plans (funded by tax-deductible contributions from weekly paychecks), the majority of people are clueless about how to invest their savings.

Instead, they fork over their savings to financial advisors, and trust them to act in the benefit of their clients. Oftentimes, advisors will betray investor interests for the purpose of earning commissions for themselves and the firms at which they work. Similar to how most salesman make a living, there is a base salary and a bonus determined by the percent of total asset under their management. Intuitively, the more money an individual client invests, the “fatter” the advisor’s compensation can be, making it understandable as to why they recommend other investment vehicles than index funds. Nonetheless, such actions are still unethical.

Jack Bogle, back in a 2004 keynote speech, publicly voiced his discontent about the widespread industry practice of breaching fiduciary duties to investors: “Virtually all 401(k) transactions take place long after each day’s 4pm cut-off time for executing orders.” In this speech, Bogle encouraged investors to consider 12 deciding factors when choosing a high stewardship oriented financial advisor, ranging from management fees and insider ownership to fund diversification and institutional structure. This is to ensure that your financial advisor prioritizes value creation for investors over their own personal gain.

Even still, advisors partaking in illicit and unethical practices remains widespread. Nearly 80 mutual fund advisory firms agreed to refund more than $125 million (as a settlement with the SEC) to their investors when they mislead investors by failing to disclose cheaper mutual fund options. Both big banks (Wells Fargo and Deutsche Bank) and smaller-sized institutions were found guilty of such unethical practices. While our regulatory bodies work tirelessly to defend investor interests, they remain underfunded and woefully underprepared for an industry that remains incentivized to prioritize the firm over their clients. These incentives are what keep financial advisors from recommending index funds and dollar-cost averaging.

Not only do investors need to be wary of commission-hungry financial advisors and fund managers, but they also need to avoid other “schemes” of a similar sort. Fund of funds are funds whose portfolios are comprised of other funds. The logic behind these funds are that they provide more diversification than typical funds. However, such funds haven’t produced higher returns than traditional index funds (this was illustrated in real-time by a famous bet between Warren Buffett and Ted Seides of Protege Partners) and incur much higher fees because not only does the fund of funds charge fees but also the funds beneath the mother fund.

Moreover, in our latest Financial literacy article, senior columnist Darren Chow highlighted that about a third of all Americans have zero savings for their retirement and nearly 40% carry credit card debt with an average balance of over $16,000. Many Americans are clueless about executing a savings (and spending) strategy, which indicates a serious need for improving financial literacy in high school and universities.

Take Home Points

Using dollar-cost averaging to invest in an S&P 500 index fund over time allows individual investors to generate substantial wealth over a lifetime.

Although the Vanguard S&P 500 Index Admiral Shares Fund has the lowest expense ratios of any index fund available to individual investors, other index funds may have lower per share denominations that may be more accessible to readers managing smaller sums. Vanguard remains best-in-class because they prioritize low-fees and have the economies of scale to deliver the highest returns to investors.

The beauty of dollar cost averaging with index funds is that you can start with small sums and passively grow your wealth, meaning you won’t need to continually monitor the fund’s performance or stress over the market’s inherent volatility. Over the long run, this strategy realizes almost-certain investment returns that have the potential to make you lots of money—if you can stick to the plan.

Ciao ,very inteteresting blog page. vielen dank