BRB Bottomline: Most things are priced at some dollar figure plus 99 cents for good measure. It’s a common mental trick to seemingly lower the price; everyone knows that. But what’s relatively unknown is how they hide the true cost till that final ‘purchase confirmation’ where the service fees and shipping and handling fees and convenience fees show up. You, the consumer, bounded by the inertia of the purchasing decision, will end up paying that 15% service charge. This is how some make profits that are higher than normal.

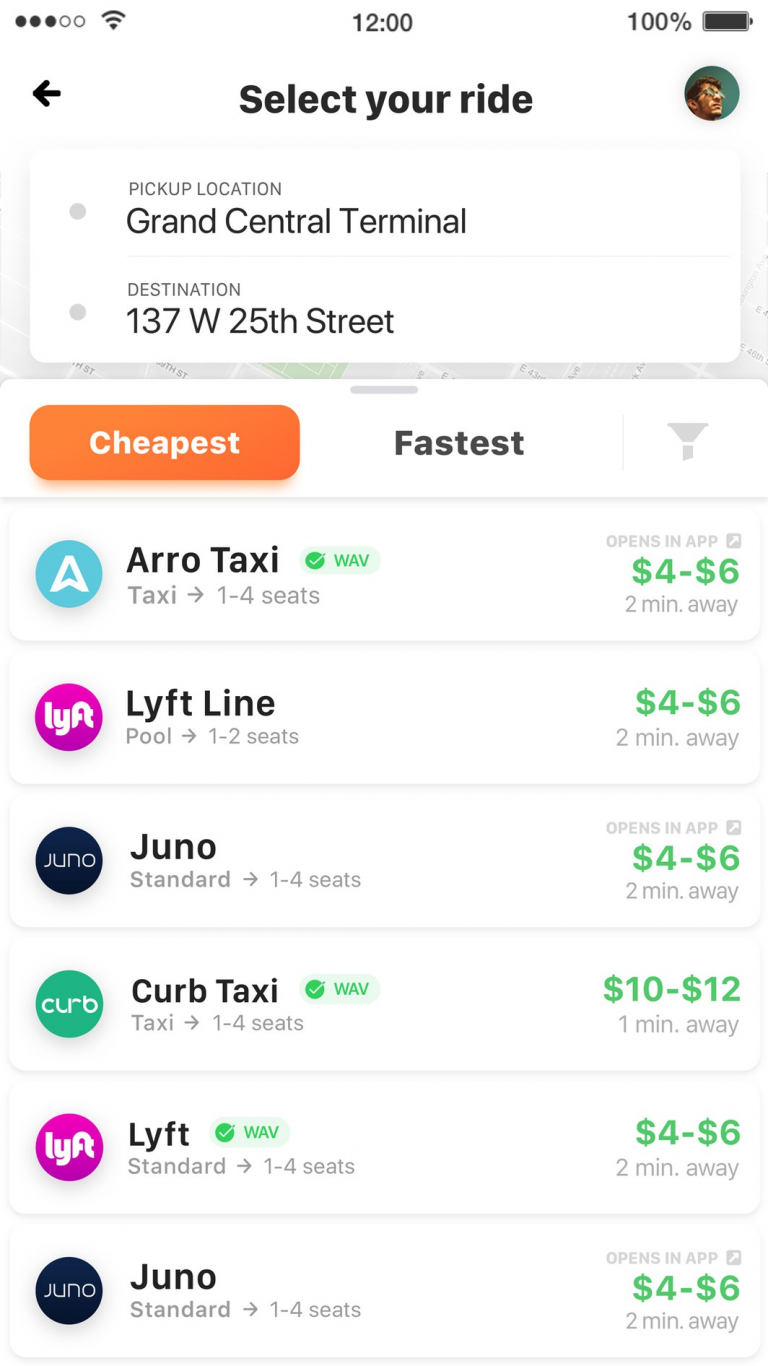

Spring break just went by. You probably went home and took a break from the familiar sight of the Campanile. But what if the restful trip began with a cab ride as expensive as the flight tickets itself. You need to get to the airport and the ride-hailing companies know this. Cue the 50% surge pricing for “Prime Time” hours. Brian Mi, a sophomore at UC Berkeley, found this out the hard way. Brian had a Saturday morning flight. He compared the prices on Lyft and Uber and found that, despite Lyft being $4 more expensive, his 50% Lyft discount would make Lyft the obvious choice. The app warned that because it was rush hour, Lyft is adding a 50% surcharge to the ride. The quote was $56 before booking. When asked about his rationale, Brian said, “it [the app] said there’s a 50% surcharge because it’s busy. Since it came AFTER you book the ride, I assumed it was included in the already expensive $50 I agreed to pay.” By the time he got to SFO, the bill came out to $91.31 due to “Prime Time + 50% surcharge,” an additional $2.20 service fee, $5 airport fee and $6 toll. Moreover, the 50% discount was capped at $6, which, to be fair, was disclosed in the small print of the promotional email.

Hacking Market Equilibrium

Econ 1 would teach you that companies must price goods and services according to the laws of competition: price too high and competition, no matter how essential the service, will drive profits down, as consumers flock to other sellers in the market. Nevertheless, companies can hold onto pricing power if they obfuscate prices and pricing calculations.

At best, obfuscation of prices impedes the ability of consumers to optimize decision making and hinders the competitive process. At worst, such hidden fees and costs can be fraudulent and deceptive. In stagnant markets with weak competition, firms with market power can raise prices without improving their products, stifle wages, and exclude new competitors due to barriers to entry.

In a December 2016 report presented to the White House, the National Economic Council showed how some industries use hidden fees to trick people into parting with more of their money than they would have preferred.

One way to take advantage of consumers to hack their brains. Rather than looking at the total price, many consumers decide to buy a good or service based on an initial low price, which because they’re committed to this purchase, go on to pay ancillary fees regardless. This is a mental heuristic called “anchoring,” first explored by Daniel Kahneman and Amos Tversky in their book, Judgment Under Uncertainty, Heuristics and Biases.

For example, a consumer might only want to pay $70 for a concert ticket. A ticket costing $80 is out of his mind. However, if the same ticket is marketed at $69, and add-on fees of $11 are added at checkout, the same consumer may still purchase because the initial price did not trigger the consumer’s mental price limit. This way of partitioning prices is called “drip pricing”, which as per the Federal Trade Commission (FTC) is a technique in which firms advertise only part of a product’s price and reveal other charges later as the customer goes through the buying process. The additional charges can be mandatory surcharges or fees for optional add-ons

A National Consumer League report discusses two ways “drip” pricing strategies are implemented and how they affect consumers: Search Costs and Obfuscation and Expectation and Normalization.

Search Costs and Obfuscation

Firstly, consumers who have expended time and energy in purchasing a product that involves a steady drip of add-on fees are unlikely to redo the checkout process once they learn the final cost of a service or product—even if the deal is no longer the best for them.

This pricing strategy complicates the way consumers search for products and allows sellers to charge close to a monopoly price, even when there is free entry into the market. This is the Diamond Paradox first presented by Peter Diamond in 1971. If pricing is transparent, all firms are forced to charge the competitive price. When firms do hide their prices, consumers must undergo a costly search to learn prices. No matter how small the search costs or the number of competitors, market equilibrium for all firms is to charge the monopoly price.

Joe Farell, an economist at the FTC shows two models on the effect of drip pricing; the first of which shows why a firm might pursue a hidden costs strategy. The first one is simple. It shows that a firm will only adopt drip pricing if the gain in revenue exceeds the reduction in demand from consumer alienation and dissent i.e. the gain in profit exceeds the annoyance of customers caused by hidden pricing

Expectation and Normalization

Secondly, the expectation of hidden fees makes it harder for new cost-cutting competitors to enter the market since consumers just expect to be saddled with fees no matter what they do. Due to prior hidden fees in a particular industry, consumers are conditioned to think that a low price just means they will faces fees at checkout. Therefore, they are wary of the low prices of a new competitor.

The second model by Joe Farell shows this fact. If the lack of transparency makes consumers wary of a price discount offered by a firm, then the elasticity of demand will fall, reducing the incentive for the firm to cut price. Consumers’ expectations about add-on prices will affect the ability of a genuine price-cutting firm to attract consumers and the ability of a firm to offer a worse deal by making prices less transparent. For example, subjects who have traveled by air recently were less sensitive to drip pricing. They were more likely to accept higher prices due to “drip pricing” since they’ve been normalized to experience additional fees in aviation. But consumers were taken aback by hidden fees while renting a car, such as extra charges for GPS or total accident coverage, when these features may be acceptable or even beneficial. This increase in consumer cynicism is not productive for the market or society.

Why Choose Transparent Pricing Then?

Given that firms might enjoy higher profits using “drip pricing,” why would any still pursue a pricing policy of showing the true cost? One reason might be that opaque prices in an industry might not be stable because an individual firm that advertises a clear price can disrupt the status quo. The do-gooder firm has an incentive to reveal the hidden portion of the price to attract customers. The clearer it makes the prices it charges and prices the competitor’s charge, the more valuable it is to consumers.

For example, take a look at Brex, whose website shows this.

Additionally, the practice of hidden fees opens up a market for companies which make transparent price comparisons. For example, there have been many aggregator apps that help riders compare fares and travel times. One of them is Bellhop whose CEO and cofounder Payam Safa told Wired that “there are too many ride-sharing apps and you don’t have transparency to make decisions.”

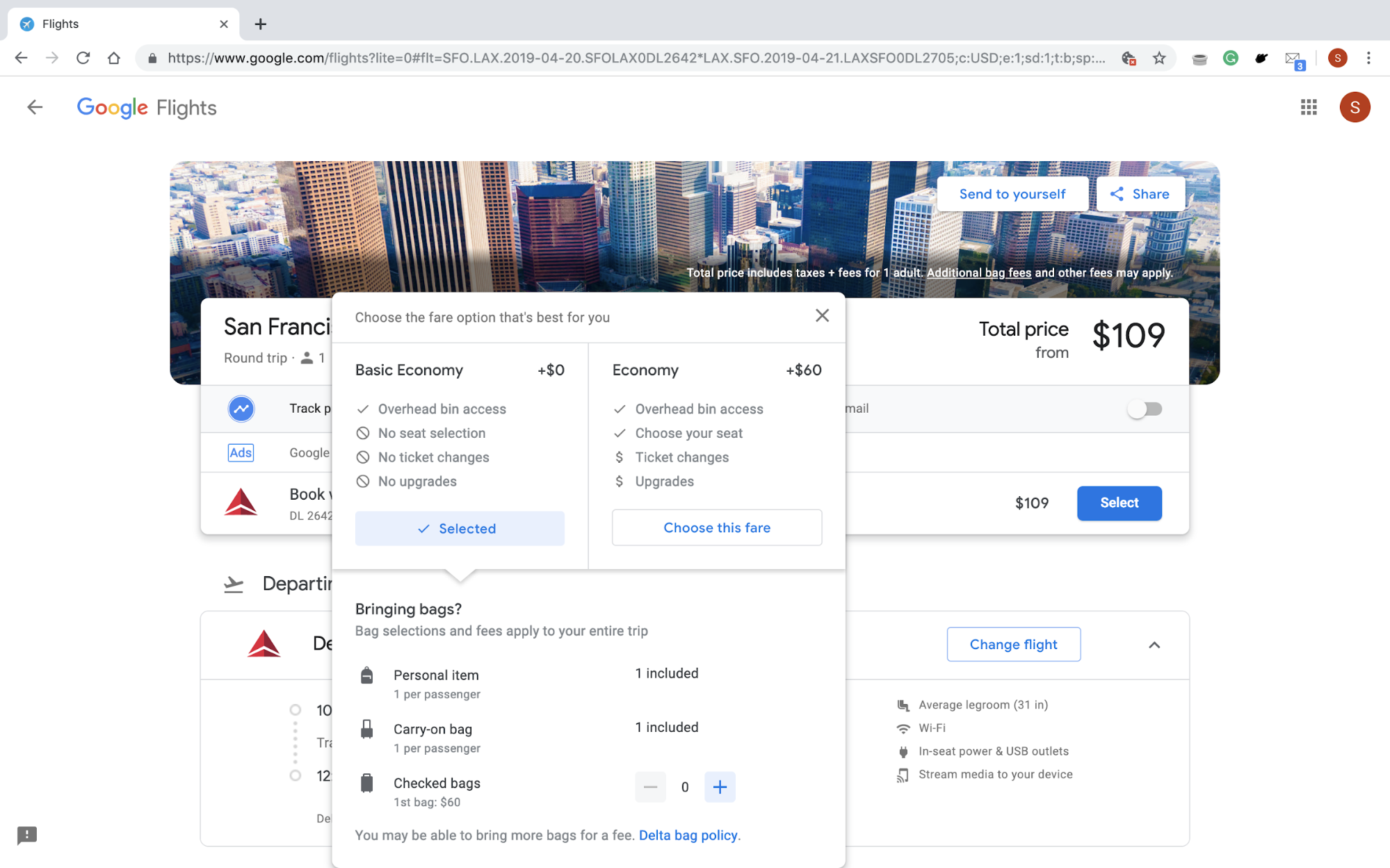

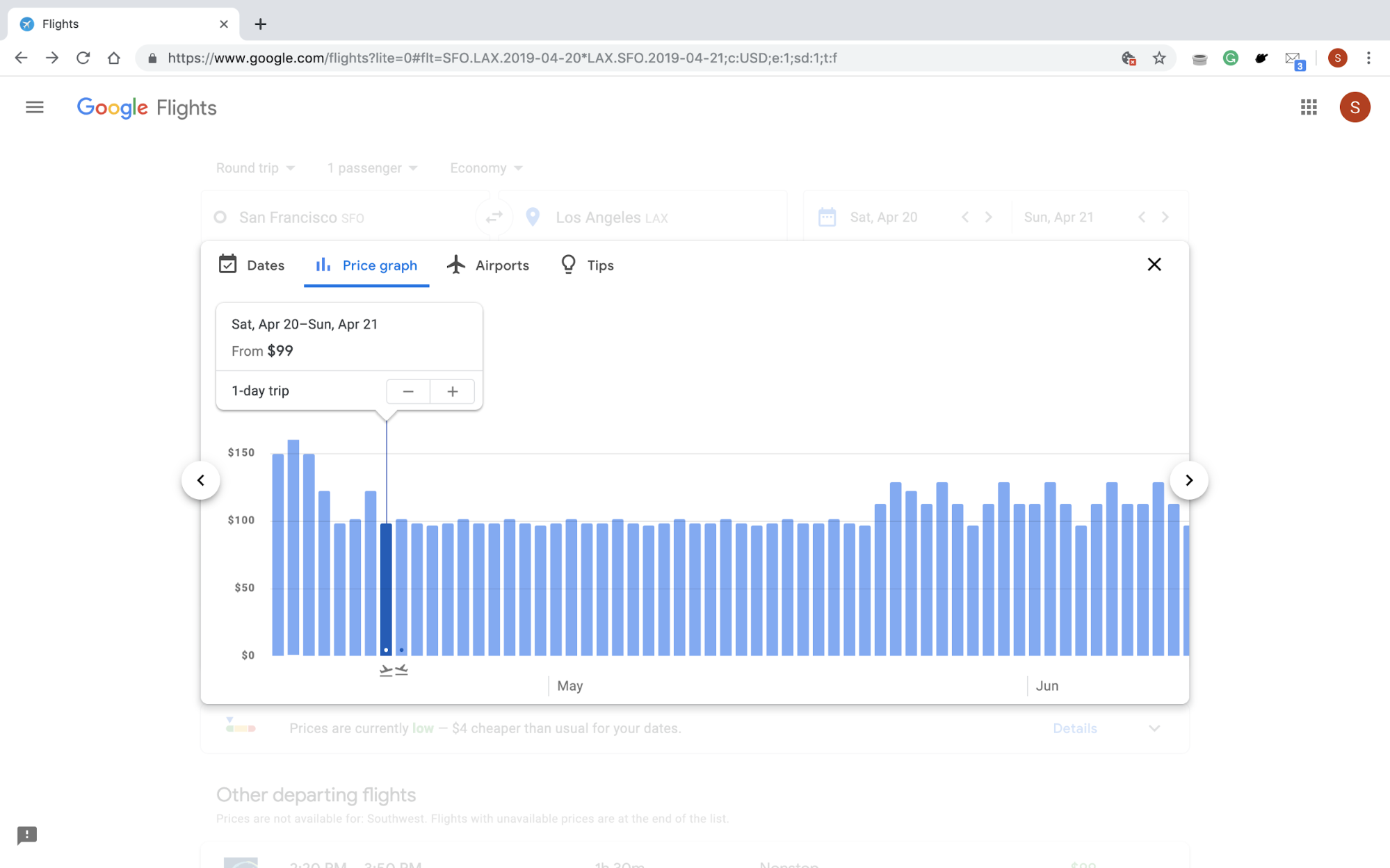

Most third party air ticketing sites are trying to make prices more transparent, or at least be upfront about the services offered for the price advertised. Take for example google flights which shows baggage fees, airline class information, and price trends clearly.

Such companies are based on price transparency. They effectively become clearinghouses for prices and disseminate price information to build trust. The FTC, in an experiment, showed that when mandatory and optional fees were disclosed before the choice decision, subjects were more likely to buy optional add-ons and had higher repeat purchase intentions.

Amazon is one company which has certainly done that. Amazon, which is very transparent in terms of pricing and shipping rates, has used price transparency to build consumer trust. Sacrificing short term profits, they have built long-term trust with consumers and found a path to long-term profitability.

Take Home Points

Companies with pricing power want price opacity, which might mean big profits now at the expense of alienating consumers. They will still add on random fees and consumers will still keep paying them. However, to counter this strategy of drip-pricing, new opportunities arise for those companies which use price clarity as a competitive advantage. They seek to add value to the consumer through their transparency. These companies are able to build trust, which companies with hidden costs have eroded, and translate that rapport into profits in the long-run.