Author: Sydney Sibrian, Graphics: Erika Hayashida

The BRB Bottomline: With bold reform and economic vision, Claudia Sheinbaum leads Mexico towards a potentially innovative future, facing high stakes in her historic first term.

The first 100 days of a president’s term are a closely monitored and contentious period that lays the groundwork for the social and economic policies of the near future. In Mexico, a country whose economy is slowing down, newly appointed President Claudia Sheinbaum seeks to redefine the national trajectory on her terms. Her election was momentous, breaking the glass ceiling in Mexico’s 200-year political history as the country’s first female president. Despite her landmark victory, concerns surround her ability to push the country forward. Now, over a month into her first 100 days, economic and energy reforms are at the forefront of her policy initiatives. Her success, and Mexico’s, will ultimately depend on her ability to balance her predecessor’s populist rhetoric with policy innovation while navigating an increasingly complex geopolitical landscape.

Scientist to Stateswoman: Sheinbaum’s Rise to Power

Although Sheinbaum is new to the presidency, she is not new to politics. A scientist-turned-politician, she received her PhD in Energy Engineering from the National Autonomous University of Mexico and completed her thesis at the University of California, Berkeley (Go Bears). In 2000, she began her political career as former President Andres Manuel Lopez Obrador’s (AMLO) environmental minister during his five-year mayoral reign in Mexico City. Following her first stint under AMLO, she joined the Morena Party and later succeeded Obrador’s position as mayor of Mexico City from 2018-2023 before stepping down to receive the presidential nomination.

Sheinbaum walked away with nearly 60% of the vote in June’s presidential election, winning an astounding 31 of 32 states. A margin this large is generally unusual, especially considering Mexico’s competitive pluralist electoral system. Her victory can be attributed to firing up the Morena Party’s base as AMLO’s protégé, but also through her receptiveness to international institutions and economic systems and mediation with the country’s elite. Though progressive, Sheinbaum seems to shy away from the populism of her predecessor, adopting a more pragmatic approach.

Before the new president can implement any of her innovative initiatives, she must first use her newly acquired free reign to tackle pressing issues left by past administrations, including the critical state of the economy.

Crisis and Continuity

Shienbaum inherited a complex economic landscape shaped by her predecessors, which left Mexico burdened by debt, inequality, and corruption. Former president Enrique Peña Nieto’s (EPN) administration from 2012-2018 saw the country virtually fall apart, as cartel violence surged, reports of government bribery emerged, and fiscal deficits grew. As a result, internal debt rose to 50% of GDP, and over 50 million people were instated below the poverty line. Rather than uplifting the people, he built his wealth and power on their backs. EPN’s failure opened up a window of opportunity for AMLO’s populist rhetoric to gain political traction.

Armed with an anti-establishment agenda, AMLO focused on uplifting the general populace through strategic initiatives: increasing the minimum wage to 85% above the inflation rate and reinforcing autonomous unions. Moreover, he prioritized domestic industries and injected cash into state oil companies. AMLO’s commitment to fiscal discipline waned throughout his tenure as he sought to secure the Morena party’s political dominance, culminating in the largest fiscal deficit in 30 years, but simultaneously ensuring Sheinbaum’s victory.

Upon exiting office, AMLO left Sheinbaum a parting gift, building on his popularity with the Mexican people. Mexico is now one of the few nations to elect its judges via popular vote, rather than by political appointment. As a result, thousands went on strike, as the judicial overhaul undermined checks and balances within a democratic government already plagued by corruption. AMLO’s actions during his last few months in office have unnerved foreign investors and Mexican markets, causing the Mexican peso to hit a two-year low exchange rate with the U.S. Dollar.

Mounting Economic Pressures

When Sheinbaum assumed the presidency, her administration was met with a long list of additional economic challenges. In October, the International Monetary Fund readjusted 2024 GDP growth predictions to 1.5% from 2.4%, reflecting expected manufacturing weakness and a decrease in domestic construction. Next year’s IMF forecasts fared even worse, with growth predicted to decelerate to 1.3% compared to a 2.2% 10-year average (excluding 2020-21 due to COVID-19 irregularities). A combination of capacity constraints and ineffective fiscal policy pose major issues for Sheinbaum’s economic plan.

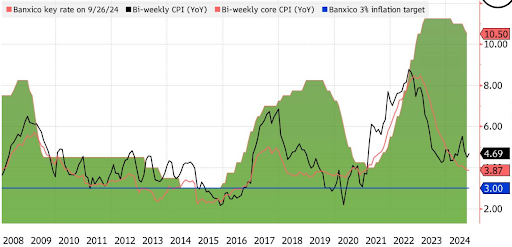

Since Sheinbaum’s election victory, the Mexican peso’s strength has fallen, meaning the Mexican consumer’s ability to consume imported goods has been hindered. The economy took another hit this past month, when inflation rates rose to 4.69%, a development that complicated the central bank’s plans for further rate cuts, and highlighted how import-heavy developing countries can be impacted by a devalued currency.

Figure 1: Mexico’s Inflation Accelerates to 4.69%

Prices of food in particular have driven up inflation. A report from Mexico’s National Institute of Statistics and Geography (INEGI), showed inflation data for grocery items alone at 9.66%. Already an unequal country, this data point is a fatal blow to the purchasing power of Mexican citizens. Sheinbaums’ economic inheritance is influenced by international factors, though her intention of curbing both consumer and manufacturing concerns through tax incentives and other investment initiatives and her more moderate outward appearance should steer Mexico in a more positive direction, primed for economic growth.

Sheinbaum’s New Way

Sheinbaum ran on a platform of expanding infrastructure development and supporting nearshoring in the process. Nearshoring refers to the practice of relocating business operations to a nearby country. Sheinbaum has introduced a host of new policies with goals of foreign investment influx and energy sustainability. Tense US-China relations in the past 10 years have created favorable conditions for an export surge, yet once again, this is dependent on foreign sentiment towards the nation. Now in this opportune moment, Sheinbaum looks to advertise Mexico as a particularly attractive hub for companies like Foxconn to set up shop, as the administration seeks more internal political stability and an easing monetary environment.

Figure 2: Foreign Direct Investment Composition and Trends (2016-2024)

For investors, Obrador’s previously noted judicial reform has created unease around political risk, this skepticism has spilled over into a weakening FX and domestic bond market. Sheinbaum has taken steps to reaffirm the overhaul as an anti-corruption measure instead of an anti-democratic one, anticipating what offerings Mexico must have to be competitive in drawing additional private investment.

In October, she unveiled the formation of Mexico’s Agency for Digital Transformation tasked with reducing the red tape surrounding private firm operations. It’s a step in the right direction and will cut down the over 7,000-step permitting process by half. Where simplification is an afterthought for others, it is central to the new president’s agenda.

And the best part? It’s yielded results, and quickly. On October 15th, a 20 billion dollar project led by giants Amazon and Woodbridge was announced. This project is just what the country needs to increase infrastructure and energy efficiency. Woodbridge’s plan would pump 10.4 billion dollars into a deepwater project with Petroleos Mexicanos (Pemex), a state-funded oil company. Overextended refineries would face reduced pressures, giving the new government more capital for other measures.

By aiding the interests of large corporations (in contrast to AMLO’s interests), Sheinbaum is creating relationships that will instill more confidence in Mexico’s industrial capabilities going forward. After a private meeting with Sheinbaum last Thursday, billionaire Carlos Slim echoed similar sentiments, telling the press that Mexico should expect “many very good years in the future.” Shienbaum’s close alignment with corporate powerhouses demonstrates her desire for a Mexico that is business-friendly and resilient, strengthening the nation’s position.

Energy Reforms

As a politician with firsthand experience formulating climate policies, Sheinbaum’s economic plan also aims to implement a new green agenda. This innovation was previously impossible under the former administration, during which many green-energy projects that deviated from AMLO’s administrative goals were sidelined entirely. Now, she’s fully able to push Mexico towards a greener future.

In line with Sheinabum’s clean energy ideologies and aided by Morena majorities in both chambers, Mexico’s senate approved an energy reform bill in mid-October that allocated $13 billion toward renewable energy projects.

Sheinbaum’s big-ticket energy plan aims to increase the stake of state-funded energy to 45% renewables, a steep hike from where it currently sits at 24.3%. In a country where 77% of electrical supply comes from fossil fuels, the likelihood of success is a pipe dream, seeing as the estimated cost of investment and distribution alone is at 50 billion dollars. Even so, the long-term implementation of this plan along with Sheinbaum’s current ability to pass legislation, makes reaching the 45% projection more manageable.

While a clean economy is a major focus of her administration, Sheinbaum’s policy also aims to balance existing energy initiatives that have backtracked in recent years. One of these projects is state-owned oil firm Pemex. Formerly one of the world’s most influential oil firms, Pemex became an unwanted financial burden to the Mexican state. Today, the firm’s debt exceeds that of any other oil company globally sitting at $100 billion dollars, with maturities expected to rise.

Figure 3: Pemex Debt Maturity Predictions as of 2024

During her campaign, Sheinbaum vowed to “strengthen Pemex,” a promise that she intends to keep. Many disagree with the course of action, including Fernanda Ballesteros, a country manager for the Natural Resources Governance Institute. Environmental experts claim that Pemex will be a “big challenge,” if not the biggest one she faces during her time in office.

Sheinbaum must develop a strategy that balances Pemex’s output and debt restructuring while maintaining commitments to sustainable practices. The green-energy agenda she seeks to implement does not denounce petroleum, rather it promotes its responsible use in tandem with a green energy transition. This angle makes her task more practical and feasible to envision.

Navigating US-Mexico Relations

Since Mexico’s independence, the United States has been its most important trading partner. The health of Mexico’s economy depends very heavily upon the man (or woman) sitting in the Oval Office. With the U.S. election climaxing tonight, potential shifts in economic policy pose major concerns.

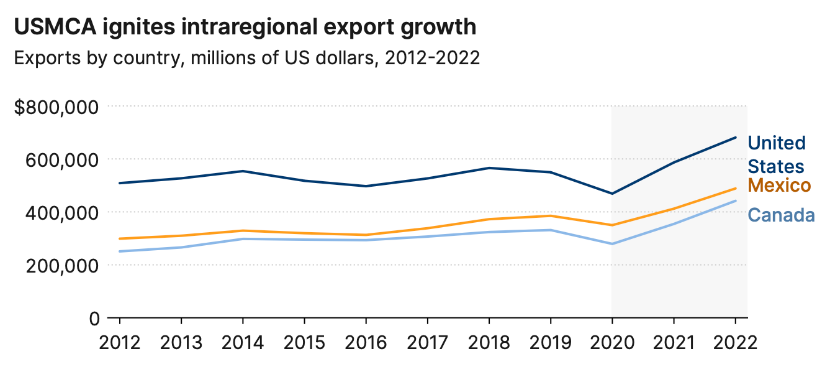

Razor-thin margins separate Vice President Kamala Harris and former President Donald Trump. A CBS News poll early last week had both candidates at 50% respectively in battleground states. Despite drastically different political ideologies, both agree on invoking a complete review of the United States-Mexico-Canada Trade Agreement (USMCA), a deal Mexico is content to keep. Since 2020, USMCA has bolstered foreign direct investment and trade with Mexico.

Figure 4: USMCA boosts export growth across US, Mexico, and Canada

For Sheinbaum, the challenge lies in preserving the current trade deal, with as few concessions as possible. If the election yields a Trump victory, isolationist biases will infiltrate the political decisions as revealed by campaign promises of a 100% tariff on all automobiles crossing from Canada and Mexico. Though it is an outrageous claim and an implausible policy, a Trump administration potentially imposes high tariffs — though not 100% — that would seriously hinder Mexico’s manufacturing systems. It poses a risk to Sheinbaum’s work on Mexico’s marketability, however, given recent praise and the success of her new policies, the nation remains in a good position to tackle challenges that may arise.

Harris’s plan with the USMCA is to rebuild the US automotive industry and create an opportunity economy. Her stance on the matter labels the USMCA as insufficient in protecting American workers. What that would specifically mean in terms of her negotiation focus remains ambiguous. It’s unclear how potential negotiations will go with Sheinbaum at the helm. Given how quickly Sheinbaum has taken the initiative and reaffirmed the world of a certain Mexican resolve, however, the Ice Lady should be a formidable diplomatic partner to her neighboring counterparts, regardless of tonight’s winner.

Conclusion

Just over a month in, Mexico’s outlook already looks much more promising. Sheinbaum brings a new perspective to the table, one centered on renewable energy, economic stability, and the establishment of Mexico not just as a mule but as a powerful and dominating manufacturing force. If Sheinbaum can correctly navigate the early pressures she faces, she will solidify her legacy and transform Mexico’s as well. The stakes are higher now more than ever, but so is her resolve to make history.

Take-Home Points

- As Mexico’s first female president, Claudia Sheinbaum aims to set a new direction for the country, focusing on economic and environmental reforms.

- Sheinbaum’s leadership emphasizes renewable energy, economic stability, and building Mexico’s global influence, with her legacy dependent on overcoming early challenges.

- Early days in office saw economic setbacks, including downgraded GDP growth predictions and increased inflation, particularly impacting commodity prices.

- Sheinbaum promotes nearshoring and private investment, she recently announced a $20 billion investment from companies including Amazon and Woodbridge.

- Energy reform plans aim to increase state-funded renewable energy to 45%, though Pemex’s $100 billion debt possesses challenges to sustainability goals.

- US relations remain crucial as Sheinbaum seeks to maintain the USMCA agreement amidst potential policy shifts from the upcoming US election.