Author: Felicia Mo, Graphic: Nina Tagliabue

The BRB Bottomline

You never know if the daily necessities or accessories you purchase could turn into unconventional economic indicators used to predict the next recession. The lipstick and men’s underwear indices are just two interesting trends that have held up against past recessions; let’s see how they do against COVID-19.

You’ve all heard it by now: if COVID-19 hadn’t already slashed the global economy, Russia’s invasion of Ukraine definitely reopened a wound that barely had a chance to heal. Hopefully, and I say this while knocking on wood as the COVID-19 crisis in China continues to spiral out of control, the worst of the pandemic is over. Looking back on the global recession caused by COVID-19 (not that it has ended yet), it is interesting to analyze how human behavior has changed and, likewise, how the effectiveness of economic indicators that rely so heavily on human behavior has changed analogously. The two indices of focus in this article are the lipstick and men’s underwear sales indices.

The Lipstick Index

Some Vocabulary

To understand the lipstick index, we need to review how the concepts of the income effect, the substitution effect, and inferior goods come together. It seems like a lot of vocabulary, but the concepts are simple.

Income Effect: a higher income corresponds to greater purchasing power and thus usually a greater quantity of goods purchased.

Substitution Effect: when the price of a good rises, consumers tend to switch to cheaper alternatives, or substitutes, causing the quantity consumed of the original good to decrease.

Inferior Goods: a special type of good for which demand drops when a consumer’s income rises (as opposed to a “normal good,” with which the opposite happens). Consumers with a higher income are more inclined to splurge on expensive alternatives (like how sales of instant ramen go down when you have more money because you can afford to have nicer meals).

Knowing these definitions naturally makes them intermingle — like a series of moves in a Yu-Gi-Oh! card game. If the income effect is in play (“I play this spell card!”), then it could trigger the substitution effect (“Activate trap card!”), which would make inferior goods more powerful (“I raise the stats of my monster card!”).

In other words, rising prices cause consumers to switch to cheaper substitutes, and those substitutes are often inferior goods previously ignored by consumers.

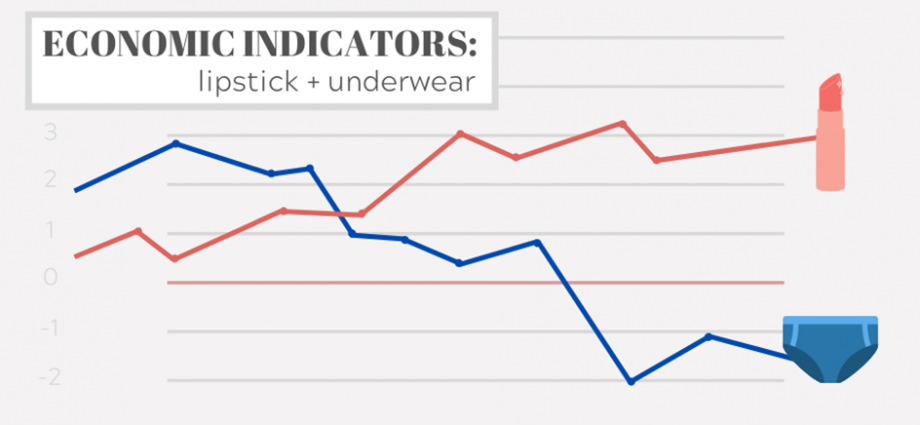

Lipstick Effect

Lipstick is one such example of an inferior good during most economic recessions. During the post-9/11 recession resulting from the ensuing market chaos and panic selling, Leonard Lauder, then the chairman of beauty company Estee Lauder, observed a rise in lipstick sales despite the overall economic downturn, based on one of the company’s sales indicators known as the Leading Lipstick Index. Lauder coined this phenomenon as the “lipstick effect.”

“When lipstick sales go up, people don’t want to buy dresses,” said Lauder to the Wall Street Journal in 2001.

In short, purchasing a $500 luxury bag or dress is more expensive than purchasing posh, bold lipsticks with names like “red glorioso” and “sweet cherry.” Lipstick can also be applied anytime, anywhere, as many times as a consumer wants, and makes consumers feel confident and fresh. Hence, when consumers tighten their purse strings, lipstick suddenly becomes an affordable but still morale-boosting substitute for indulging in appearances.

If that doesn’t already make intuitive sense to you, consider the following scenario: suppose you enter a store with the intention to purchase something to spice up your look during a dreary recession. You have $500 in your pocket and are presented with the option of purchasing a handbag that costs $500 or lipstick that costs less than 10% of the price of the bag. You don’t know where the recession will take the economy or your money, but you really want to purchase something right now in order to feel good about yourself. What would you choose?

When Lauder saw the rise in lipstick sales, he attributed it to the current recession at the time. Recessions tighten purse strings. And tight purse strings are attracted to cheaper alternative goods.

Current Trends in Lipstick Sales

The lipstick effect is more than just an isolated phenomenon seen during the 2001 recession — it has held true since the Great Depression. While the United States’ overall industrial production dropped in the 1930s, cosmetic sales rose from 1929 to 1933. The lipstick effect was also present in all four recessions between 1973 and 2001. During the Great Recession, however, US lipstick sales dropped by almost 7%, causing lipstick to be considered one of the weakest products in the beauty industry. But, if we extend the lipstick effect to include all cosmetics, the trend holds true, as sales of overall cosmetics still increased.

Similarly, the COVID-19 recession hit lipstick sales harder than other cosmetics. Global management consulting firm McKinsey tracked Amazon sales in the US between March and April 2020 and recorded a drop in lipstick sales of 15% as lockdowns spread across the world. On the surface, it seems like the lipstick index is flawed — until you think about what COVID-19 means for people wearing lipstick.

COVID-19 is a unique challenger. Imagine putting on lipstick in the morning only to stay at home for the rest of the day or putting a mask over your lips whenever you step outside. What’s more, after a long day of hard work, how would you feel when you take off your mask and find lipstick smeared all over the inside and on your chin? Purchasing lipstick simply no longer quenches your indulgence in appearance in the same way it once did.

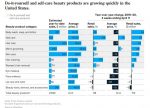

Staying at home due to COVID-19 has also perpetuated a renewed focus on self-care as opposed to impressing people with lipstick. According to a report by McKinsey, skin-care, hair-care, and bath-and-body products are all performing better than cosmetics. In fact, sales of luxury soap in France increased by 800% while the country entered lockdown. While makeup sales decreased in the US, self-care products remain popular and are steadily taking up more of the cosmetics market share.

Changing Beauty Industry

The lipstick effect may not have been applicable for this particular recession, but other beauty products have taken up the mantle. Consumers have started focusing more on hair coloring, nail polish, and mascara. McKinsey has already hypothesized the presence of a new “nail polish effect,” as nail polish sales rose in the US by 218% in 2020 during the lockdown period; similarly, on the other side of the Atlantic, the UK experienced a whopping double-digit growth of online nail polish sales. Even Leonard Lauder acknowledged that the essence of the lipstick effect has been transferred to nail polish. Nowadays, consumers already own so many lipstick shades that they are turning to creative expression via their nails. Sales of nail polish went up during the Great Recession as well.

In addition to the nail polish effect is the new “mascara effect.” When you’re constantly wearing a mask that covers the lower half of your face, the phrase “smile with your eyes” has even more meaning. McKinsey’s research shows that mascara and eye makeup experienced a 5% growth during the lockdown period. Chinese e-tailer Alibaba saw a 150% increase in eye cosmetics sales in February 2020. Luxury cosmetic brands like Bobbi Brown and Dior saw a 40% year-over-year increase in their eye cosmetic sales as well.

Management consulting firm SSA & Company’s Vice President of Consumer and Retail Practice Chris Ventry also noted that sales of long-wear foundation have increased to combat fabric masks rubbing against skin. Lipstick brands, too, are now being marketed as long-lasting and mask-proof.

The lipstick effect may be losing relevance as times change, but the concepts of inferior goods and alternatives that it is built upon hold true for new indices based on other cosmetics and skincare products.

The Men’s Underwear Index

Definition

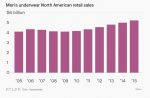

Underwear — specifically, men’s underwear — is another surprising economic indicator related to behavioral economics. According to former Federal Reserve head Alan Greenspan, who was very interested in men’s underwear (only) as a recession predictor, underwear is the least-seen garment worn by men and receives the least attention. Therefore, when a recession comes along that tightens wallets, the least likely good to be bought is men’s underwear, as men are typically willing to wait for the economy to bounce back before buying new pairs. Here are what a few experts say about the index:

“[Alan Greenspan] once told me that…the garment that is most private is male underpants, because nobody sees it except people in the locker room, and who cares? [Sales are usually stable] so on those few occasions where it dips, that means that men are so pinched that they are deciding not to replace underpants.” —NPR correspondent Robert Krulwich

“It’s simply a bellwether. When people are feeling confident, they spend more. The last thing you’re going to do when you’re short on cash is go and replace your underwear.” —Research firm Mintel senior analyst Bill Patterson

“Men will make do with a set of underwear that does the job (if you have not heard of the joke that men’s underwear can be worn at least four days, use your creativity to figure it out), whereas women probably will not.” —University of Sydney senior lecturer in finance Andrew Grant

In the Case of Covid

The underwear index held true during the Great Recession when men’s underwear sales decreased in 2008 and 2009 but recovered in 2010. As for the COVID-19 recession, Big W, an Australian chain discount department store, said that its sales of men’s underwear had been increasing in 2020 but fell in June of 2021 when COVID-19 lockdowns reached Sydney and Melbourne.

However, for Big W stores still open, underwear sales remained strong. Aussie Bum, an Australian men’s underwear manufacturer, reported one of its best sales years in 2020 despite ongoing lockdowns. It turns out that this demand for underwear could be attributed to the desire to be comfortable while locked in at home. So while a desire for new underwear might not have come across to men running low on funds in the past, it has become one of the self-care products that might be worth investing in while you are operating from your bed and wearing pajamas most of the day.

The COVID-19 recession has, without a doubt, changed the way we look at our special economic indicators. The following section summarizes a few additional fun indicators to look out for.

Other Unconventional Economic Indices

Hemline Index

Though the hemline index has been less reliable as of late, there are still many examples in history for which it rang true. Historically, the height of the hemlines of womens’ skirts has reflected economic sentiment: higher hemlines indicated happiness when the economy was doing well, while lower hemlines indicated somberness when the economy took a downturn. Hemlines rose before the Great Depression and then fell when the economy crashed. Similarly, this pattern was evident during the 1960s postwar boom and 1970s oil crisis; the 1960s saw short miniskirts while the oil crisis afterward witnessed long smock dresses. But, as with the lipstick and underwear indices, modern trends and the COVID-19 pandemic have changed fashion in ways that reflect new social conventions. In the case of COVID-19 lockdowns, staying at home meant dressing in whatever was most comfortable — baggy pants and sweaters, no hemlines needed.

Skyscraper Index

Perhaps it is not a coincidence that a recession often comes around whenever a skyscraper breaks the world record for the world’s tallest building. Think — MetLife Tower: the Panic of 1907. Empire State Building: the Great Depression. Sears Tower and the World Trade Center’s Twin Towers: US stagflation. Andrew Lawrence, the British economist who coined the term “skyscraper effect,” attributes the recessions that often follow the construction of world-record-breaking skyscrapers to prior economic booms. After all, only during positive financial times will corporations or wealthy individuals pour large-scale investments into ambitious construction projects that challenge the limits of human capability.

Champagne Index

When times are good, why not celebrate with a bottle of champagne? And when times are bad, a bottle of cheap beer will do. The champagne index is like the lipstick index but in reverse; champagne is the good being replaced by the inferior good when the economy isn’t doing well. Before the 2008 recession, US champagne sales were more than 23 million bottles. In 2009, that number dropped to 12.5 million.

Movie Index

Compared to a full vacation, movie theaters offer a form of escapism during recessions for a cheaper price. In 1982, a sharp rise in the unemployment rate corresponded with a 10% increase in theater admissions. When the unemployment rate fell, admissions fell as well. The same thing happened when times were tough during the 2008 recession; movie theaters remained crowded, and ticket sales increased by 17.5% in 2009. Once again, however, COVID-19 has thrown a wrench in this predictor as theaters shut their doors during the lockdowns — and watching a movie in a dark, confined space with a high risk of transmission as strangers laugh and eat snacks all around you no longer carries the same nostalgic weight.

Big Mac Index

That McDonald’s burger you ordered on the road trip? It’s an indicator of foreign exchange rates. Coined by The Economist in 1986, the Big Mac acts as a universal good whose price can be compared across nations to determine purchasing power. In December 2021, comparing the price of Big Macs in the British pound versus Big Macs in the US dollar resulted in the conclusion that “the British pound was 17.1% undervalued against the US dollar” (The Economist).

Recession Word Index

Another indicator discovered by The Economist involves tracking how many times the word “recession” appears in The Washington Post and The New York Times articles. The years 1990, 2001, and 2008 all saw spikes in the R-word. Unfortunately, these spikes occur very closely before the actual recession happens, so the index is not the best indicator of an incoming recession looming in the distance and therefore not a viable tool for long-term preparation.

Recreational Vehicles (RV) Index

In contrast to the previous index, the RV index gives you more time to prepare in advance. Recreational vehicles are purchases usually made by those who are confident in their financial stability and want to splurge for a long, adventurous road trip. In 1999, RV sales dropped, and a recession happened in 2001. In 2007, RV sales dropped again, and a recession happened in 2008. COVID-19, however, challenged the pattern, perhaps in a positive way for RV companies. Eager to leave the constraints of their homes while traveling in a safe manner, consumers are now flocking to RV rentals. RV company Outdoorsy reported a record-breaking surge in RV sales in 2020.

Dry-Cleaning Index

If you don’t have money in your pocket, chances are that getting your suits dry-cleaned is the least of your worries. The dry-cleaning index was hypothesized by Rutgers Business School professor Farrokh Langdana, who believed that “the business reported by dry cleaners would indicate whether more people were looking for work by cleaning their suits to go to job interviews” (The Daily Targum). Likewise, dry-cleaning activity decreases during recessions as unemployment rates rise. Consistently, COVID-19 lockdowns closed many dry-cleaning locations, driving down sales even further. The index does, however, have flaws, such as failing to account that clothes being dry-cleaned are not necessarily for job interviews and that an increasingly large proportion of the workforce works from home.

Take-Home Points

- The lipstick effect is an economic indicator that claims that consumers tend to buy lipstick as a cheaper alternative to luxury dresses and handbags during recessions, causing lipstick sales to increase despite financial hardship.

- The men’s underwear index is an economic indicator that says men will forgo buying new underwear during a recession because no one sees the underwear anyway, and they can afford to last a little longer.

- Other unconventional economic indicators include hemline heights, skyscraper records, champagne purchases, movie attendances, Big Mac prices, “recession” word frequency, recreational vehicle sales, and dry-cleaning sales.

- The COVID-19 pandemic, with its restrictions and impact on the lifestyle of countless individuals, has challenged the efficacy of a number of these special indicators.

Interesting article! I’m surprised by how lipstick sales continue to increase despite the overall economic downturn.