Author: Yarden Pri-Noy, Graphics: Erika Hayashida

On-demand streaming is transforming the film industry. Learn how this transition affects consumers, producers, and investors.

Introduction

Movie budgets have become insane. Large production companies pour obscene amounts of money into movies, hoping to profit from box office sales. Star Wars: The Force Awakens (2015) alone cost Disney a whopping $533.2 million to produce (grossing over $2 billion from theaters). In recent years, however, consumers have opted for streaming platforms over traditional theaters, a trend rapidly accelerated by pandemic restrictions. These platforms, which primarily make money from subscriptions, are increasingly producing their own movies in an attempt to compete directly with major producers. These films can get expensive—The Gray Man, a 2022 Netflix original film, cost over $200 million to produce. Although streaming originals seem to be at a fundamental disadvantage without revenue from theaters, they keep being produced—and they’re getting more expensive. This transition to streaming is threatening the hegemony of production companies and studios and has groundbreaking consequences for the film industry at large.

What Does This Mean for Consumers?

With around 86% of Americans paying for at least one streaming subscription, consumers are strongly invested in the future of the streaming industry. Trends in content production, content availability, and platform pricing—especially in such a volatile industry—can noticeably affect consumers.

Streaming is Getting Expensive (It’s Not Just You)

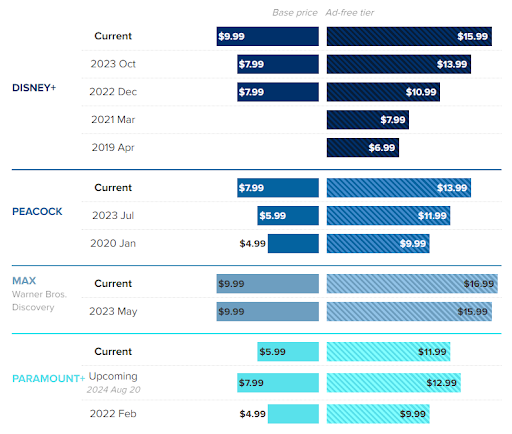

Despite more competition in the streaming industry, consumers are experiencing a gradual rise in platform prices. With traditional TV platforms losing popularity in recent years, the media giants who run them (think Disney, HBO, and Paramount) have decided to enter the streaming space. At first, these new platforms focused on rapidly gaining subscribers to compete with established players like Netflix. They began by churning out massive amounts of original content, which they only made available on their own service. They also offered their subscriptions at lower prices than Netflix and Hulu, employing creative methods such as ad-supported and multi-tier plans to compete with these existing platforms.

Having now gained a good amount of subscribers through exclusive content and competitive pricing, these companies are beginning to seek a return on their massive production investments. These production companies have been steadily raising subscription prices in an attempt to make their streaming endeavors profitable. These increases vary across different platforms and pricing tiers, but their impact is nevertheless noted.

Although these services offer lower-cost alternatives, these plans are generally very limited and priced around where a full subscription was just a few years ago. This upwards shift in pricing has consumers looking for other ways to get on-demand entertainment.

Get Your Eye-Patch Ready

In a callback to 1725, piracy is making a big comeback. Consumers have frequently been turning to online content piracy—illegally accessing copyrighted material—as an alternative to paid streaming services. In the past 4 years alone, visits to piracy websites have increased by 12%. As the focus of streaming platforms shifts towards profitability—and the legal options for on-demand entertainment become gradually less appealing—these illegal options have become popular tools to circumvent steep subscription costs and incessant advertising. Unsurprisingly, considering that consumers have access to copyrighted content without paying subscription fees (which often pay for the production of this content,) this has many studios and streaming platforms frustrated. As the popularity of piracy has ramped up, so has a crackdown on piracy sites led by the copyright holders.

The Alliance for Creativity and Entertainment (ACE) is the world’s largest anti-piracy coalition—composed of over 50 major entertainment companies and production studios including Amazon, Disney, and Warner Bros. Partnering with enforcement agencies internationally, ACE has spearheaded this crackdown. Recently, ACE took credit for the removal of FMovies, a piracy site that logged a mind-boggling 6.7 billion visits since 2023. Interestingly, anime has been a dominant force in global piracy—with 80% of top titles attracting worldwide piracy audiences. Many of the piracy websites being taken down are exclusively focused on anime (e.g., AniWave and AnimeSurge.) Despite the efforts to enforce anti-piracy laws, new sites are emerging at an astounding rate, possibly even faster than they are being shut down.

The rise of online piracy, while allowing some to bypass subscription fees and advertisements, is still overall detrimental to consumers. To offset losses from piracy, some platforms might raise their subscription prices. Others, most notably Netflix, are cracking down on other common payment-evasion methods like subscription sharing.

How Does This Affect Producers?

This recent shift towards streaming has also revolutionized the filmmaking industry on the production side. With declining movie theater attendance, especially during the pandemic, the most effective source of income has become subscription-based SVOD (streaming video on demand) services. This transition had game-changing implications for both huge studios and existing SVOD companies, sending everyone scrambling for profit in what has been referred to as the “streaming wars.”

Why Netflix is the Top Dog

Among all the different streaming platforms available today, Netflix has emerged at the top. This was no small feat, given the entrance of giants like HBO, Disney, and Paramount into the SVOD space. There is one main reason why Netflix is the most successful platform today—foresight. Back in the late 2010s, the SVOD business model centered mainly around licensing content from bigger production companies and making it available to consumers in exchange for a subscription fee. This was a good deal for both the production companies and Netflix; the production companies raked in some extra profit from past movies, while Netflix profited without having to invest a dime into production.

As streaming started to rapidly grow in popularity, Netflix began investing heavily in producing original content. Essentially, Netflix foresaw the vicious competition that ensued, predicting that the production companies (which it was relying upon for content) would eventually hoard their content for their own streaming platforms. With the release of AppleTV+ and Disney+, 2019 marked a turning point in the streaming industry. The slew of originals that followed were a direct result of the new SVOD business model: in-house consolidation.

Impressively, Netflix has maintained its lead in the industry, boasting the highest subscriber count and the most original content out of all platforms. As of Q2 2024, Netflix was responsible for around 25% of the world’s streaming original series, with Amazon Prime Video behind it at just 9%. Having successfully mastered the original-content pipeline, Netflix is now consistently producing movies and shows to attract new subscribers at a much higher rate than its competitors. Netflix originals have also historically made a much larger cultural impact than those of other platforms, becoming cult classics like Bojack Horseman or reviving popular interests like The Queen’s Gambit with chess.

Although Netflix has maintained a dominant position in the industry, with its stock surging nearly 90% this past year, the company is not guaranteed to remain at the top forever. Despite being famously against putting advertisements on their content, Netflix came out with an ad-supported pricing tier in 2022 after coming under pressure from competitors such as Hulu and Amazon Prime Video . Nevertheless, Netflix might have charted its path to success with its shift towards in-house production. The percentage of original content on Netflix has surpassed 55% in recent years, indicating the company’s full commitment to this strategy.

Is Streaming a Good Investment?

Absolutely. On the macro level, the SVOD industry is experiencing steady growth. If recent years are an indication of the near future, the streaming industry will continue to experience this growth. The tricky task, however, is choosing which streaming platform to invest in. As the market grows, the different platforms compete more aggressively, and the choice of which platform to invest in becomes more important to the retail investor.

High Risk, High Reward

Considering all the fast-paced changes that have occurred recently, the streaming industry has become extremely volatile and reactive. The few existing streaming platforms are jockeying for their own share of a rapidly growing market; all trying different strategies to achieve that goal. Although Netflix currently leads the industry, its continued dominance depends on its ability to continuously provide a better service than other companies. As competitors attempt to overtake Netflix, they introduce pressures, such as competitive pricing or exclusive content; often forcing Netflix to adapt and change its strategy. For example, Netflix is experimenting with shoppable integration as another possible source of revenue.

Despite the fierce competition and the volatility of the industry, Netflix has been doing well for itself. Earlier this month, Netflix reported a 15% increase in revenue during Q3. This was driven by growth in both membership and advertising revenue, especially since around half of these new subscriptions were for the ad-supported tier.

This isn’t to say other streaming sites are doing badly. As I’ve mentioned, these newer entrants to the streaming industry are still chasing profitability. In fact, the only currently profitable streaming platforms are Disney+ and Netflix. To achieve this goal in such an unpredictable market, these companies are turning towards bundles, advertising, and account-sharing crackdowns.

Finally, another interesting trend is that subscription numbers in the United States, while still growing, are doing so at a diminishing rate. This plateauing growth suggests oversaturation in the U.S. market, which could incentivize these platforms to set their sights on the broader global film industry.

All of these factors contribute to a complicated and hyper-competitive industry where a company can fail or succeed for a variety of highly unpredictable reasons. In such a space, it can be extremely difficult to tell which company is in the best position to succeed. On one hand, Netflix currently seems to be in the best position to maintain its continued success in this industry. On the other hand, competitors could overtake Netflix by beating it to a new, more effective source of revenue. Ultimately, the next few years will be crucial in assessing which companies are best-positioned to adapt to the fast-changing landscape and succeed.

Take-Home Points

- Consumers are increasingly opting for streaming platforms. This transition threatens the hegemony of production companies and studios in the filmmaking industry, having groundbreaking consequences for the industry at large.

- Among all the different streaming platforms available today, Netflix has emerged at the top.

- As more time passes, and the streaming industry becomes older and more established, it will become clearer what the industry trends are, and which companies are best-positioned to succeed.

Its superb as your other articles : D, regards for posting.

Great post. I was checking constantly this weblog and I am impressed! Very helpful information specifically the closing part 🙂 I take care of such information much. I used to be seeking this certain information for a long time. Thank you and best of luck.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

Very interesting subject, appreciate it for posting.

Very thought-provoking content here. Thanks for putting this together. This article made me stop and think.

I can see how this applies in real life. Your knowledge on this topic really shows. Your insights really stand out.

Very well researched…. Great mix of information and simplicity.!

Informative and clear…. Really makes complex topics easy to understand..

Learned something new today! This made my day a little easier.

Very informative read.. Clear and concise guidance.

Nicely written piece!… Bookmarking this for later reference..

The topic was well explained. You should write more often.

Pretty solid content here. Keep up the great work!.