Author: Minh Phan, Graphics: Carol Lu

The BRB Bottomline

Biden’s new approach to cryptocurrency regulation questions the idea of a free market. Yet, U.S. investors take sides as some believe it will prevent crypto-based criminal activities and others believe it to be a prevention from technological innovation.

The digital currency market is a revolutionary realm of investing for teenagers and adults, but it is still an unknown market for many and holds dangers for newcomers. In recent years, news of people making fortunes overnight from digital cryptocurrency have flooded the internet. Attraction to quick and “easy” ways to make money instantaneously draws many people’s attention, along with those who want to take advantage of others to get ahead of the game. Scammers, hackers, and digital asset tax evasion have become more apparent, leading to the government’s intervention toward this highly unregulated market.

What Exactly Is Digital Currency?

Before diving into the meaning of digital currency, it is important to understand the bigger umbrella it is under: digital assets. Digital assets, put simply, are assets that hold contents in a digital format and can be exchanged for value. This type of asset comes in a variety of forms, with the most well-known ones including digital documents, photos, videos, and audio files. In recent years, digital assets have branched to new and popular cases, like cryptocurrencies and NFTs. Both of these forms of digital assets hold future promise, and many consider them to be technological innovations. In this article, we will focus primarily on cryptocurrencies.

Just like its name suggests, cryptocurrency, or virtual currency, is essentially currency representing a digital value that can only be traded electronically on the Internet or online networks through specific software, terminals, and mobile applications. The term “cryptocurrency” came into existence in 2012 when the European Central Bank (ECB) defined it. Two years later, the Internal Revenue Service (IRS) of the United States classified cryptocurrency as “a digital representation of value, other than a representation of the U.S. dollar or a foreign currency, that functions as a unit of account, a store of value, and a medium of exchange.” Though it still holds monetary value like a fiat dollar, cryptocurrency is decentralized and operates in an unregulated market.

Cryptocurrency is a new technological innovation that is gaining more acceptance every day. People are excited about the possibilities of such non-fungible tokens and the decentralized financial market it operates in. Just five years ago, the cryptocurrencies market was valued at $14 billion but surpassed the $3 trillion dollar cap in 2021. Approximately more than 40 million American adults have invested or traded cryptocurrencies, and more than 100 countries are piloting Central Bank Digital Currencies (CBDCs). Due to the pseudonymous nature and the convenience with which it allows users to transfer funds at any time and anywhere, cryptocurrency also appeals to criminals as a quick and easy way to get rich. The rise of such activities worried the U.S. government, forcing President Biden to issue an executive order.

Insights Into The Recent Cryptocurrency-Based Crime Activities

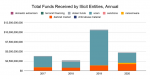

The cryptocurrency market expansion rate is an appealing number, but another noteworthy point is the total crime transfer rate and value between 2019 to 2020. In 2019, crypto-related criminal activity amounts to 2.1% of all cryptocurrency transaction volume, totaling $21.4 billion worth of transactions. However, this number fell to $10.0 billion in 2020. The graph below outlines the types of crimes with the most cryptocurrency.

From 2017 to 2020, illegal crypto transactions are apparent in the darknet market (a market in the dark web) and scams, but ransomware is becoming more prevalent from 2020 and onward. In 2019, 54% of illicit activity took place through scams making up $2.6 billion worth of cryptocurrency received. Within that amount is the contribution of the infamous PlusToken Ponzi scheme that affected millions of victims after taking in more than $2 billion worth of PlusToken (a cryptocurrency). The darknet market accounts for $1.7 billion worth of transactions. There is still a presence of cryptocurrency crime through scamming and the darknet market, but the focus is on ransomware, which populated the year 2020. Ransomware experiences an increase of 311% since 2019, making it the category of cryptocurrency-based crime with the highest growth rate.

Government Responses to Prior Executive Order

Even though cryptocurrency is highly unregulated, the government’s involvement in cryptocurrency-related crimes happened prior to the signing of the Executive Order on March 9, 2022.

A notable action from the Department of Justice is the arrest of two individuals, Lichtenstein and Morgan, who were linked to the infamous 2016 hack of Bitfinex, a virtual currency exchange. The two allegedly conspired to launder and transfer a total of 119,754 Bitcoin. At the time of their arrest, 94,000 Bitcoin remained in their illegal digital wallet, totaling more than $3.6 billion.

This seizure opened the eyes of the government and forced them to declare that “[the U.S.] government will not allow cryptocurrency to be a safe haven for money laundering.” Past events of crypto-based crimes somewhat affect the U.S. financial market and pressure the government to take heavier and clearer action towards the market last week.

The White House’s “Whole Government Approach”

On March 09, 2020, President Biden signed an executive order on cryptocurrency to make the market more centralized and safer for consumers, which makes it the first time the White House fully addressed the issue of digital assets. According to the executive order, Biden announces crypto and the digital assets world to be “a risk for everything from human rights to climate change to criminal enterprise.” The White House fact sheet notes the four main policy objectives in regulating cryptocurrencies:

- Directing the Department of Treasury and other agency partners to develop policy recommendations to make U.S. consumers, investors, and businesses safe under the growing digital sectors and to mitigate any systematic financial risks.

- Encouraging the Financial Stability Oversight Council to identify economy-wide financial risks from the digital assets market

- Mitigating the illicit finance and national security risks posed by the illicit use of digital assets by working with agencies and allies to ensure a stable and safe international framework

- Placing urgency on research and development of a possible U.S. central bank digital currency (CBDC).

Is This Bad For Us? You Can Decide

Following the executive order is the separation of the U.S. consumers in general, and crypto users in particular. Former Assistant Treasury Secretary Gregory Zerzan addresses that this “top-down government approach” is “not a pathway to innovation.” Turning most, if not all, government agencies’ focus to crypto would limit the natural way the market can grow and become a technological innovation for the country. By making the Fed the center of digital assets, there would be too much information on individual purchase and investment decisions sitting in one place, making it vulnerable to hacking and ransomware. Furthermore, a central bank digital currency in the U.S. threatens the accessibility of business and consumer credit by reducing deposits at private banks and forcing individuals to go through the Fed.

Yet, in the light of negativity, many people support this new take on the digital assets world by the government. Many advisors and crypto experts announced their support of the executive order as they believe the federal government has been on the sidelines in the crypto market for too long. By allowing the crypto market to take shape on its own, there have been many “shady sales pitches, rampant instability, and illicit activity.” In addition, the government would not have a hard time creating regulations surrounding digital assets as there are many ways cryptocurrencies can fit into existing government infrastructure.

The Official Monetary and Financial Institutions Forum (OMFIF)’s report on global central banks’ trust from consumers finds that central banks “have the highest trust rating of all the monetary service providers.” According to Figure 1.2, the U.S. central bank has 30% trustworthy, but the percentage of untrustworthy of around 28% is almost equivalent. This further supports the idea mentioned earlier that the U.S. consumers split into two sides when it comes to siding with the Fed. The remaining question for you is, would you rather have a regulated crypto market to prevent criminal activities or a hands-off approach from the government to let the market progress naturally?

Take-Home Points

- More and more people are interested in cryptocurrency and many even take on the topic as their main career.

- Yet, its characteristics of being highly unregulated and easy to access make the market appealing to criminals as well. Scams, ransomware, and other criminal activities are also growing alongside the market.

- On March 9, 2022, the White House decided to take a more comprehensive approach to regulate and improve this new financial market.

- The remaining question is whether or not consumers will benefit from it or this highly government-involvement approach will slow down technological progress if the market is left unchecked otherwise.

Not no but HELL NO “F”ING WAY!!!! FJB!!!!! Look at FTX which is the same as Biden’s BS digital currency!!! Research yourselves!!!

The problem l believe is the fact that the digital currency will expire at some point. Not good for the people.