Author: Jay Sahaym, Graphics: Carol Lu

The BRB Bottomline

The ongoing Turkish lira crisis is ample evidence to suggest that the economic policy followed by the Erdoğan government could spell doom for the emerging market economy.

Under President Recep Tayyip Erdoğan, Turkey was supposed to be a growing powerhouse on the global stage. In recent years, the country has played a key role in international politics due to its position between Europe and the Middle East, with its influence being felt in NATO and through the Syrian refugee crisis. Despite the country’s growing status on the global stage, it has faced a series of challenges, both internal and external, from coup attempts and an increasingly authoritarian government to conflicts with the United States.

Pumped Up

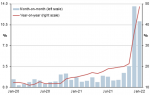

The most recent of these trials facing Erdoğan and his government is the Turkish lira’s massive slide in value compared to the United States dollar. The lira has fallen over 40% since the start of 2021, with a drop of nearly 26% in the month of November 2021 alone. Furthermore, inflation officially increased to the extremely high value of 20% through November 2021. However, the rise did not stop there, going all the way up to the horrific figure of 48.7% year-on-year.

Conventional economic wisdom dictates that the Central Bank of the Republic of Turkey should raise interest rates to reduce inflation. During a similar currency crisis in 2018, caused by worsening relations with the United States, the Central Bank did eventually take steps to stop the lira’s depreciation, raising rates from 8% to 24%.

Erdoğan’s Great Economic Schism

However, Erdoğan has indicated that he is unwilling to do the same this time. Contrary to widely accepted economic principles, the president, perhaps drawing on certain Islamic thoughts on usury, believes that high interest rates are the cause of inflation. These unorthodox beliefs have recently become much more relevant to the Turkish people. In 2018, the government of Turkey became more centralized, giving more power to the executive branch. This restructuring has led to the reality that Erdoğan is in direct control of most, if not all, policy spheres, including economics. The Central Bank has essentially been transformed into a stage upon which Erdoğan can cast actors. Several top officials, including the governor and multiple deputy governors, have been fired and replaced with those he finds more amenable to his economic views, though the situation has not exactly improved.

Based on the policy decisions taken in 2021, and extremely generous rationalization, one might assume that the government was attempting to gain a competitive advantage for trade by making exports cheaper. But Turkey imports much of its energy and raw materials for manufacturing, which means that devaluation would not have the desired impact. Compounding Turkey’s economic woes is the fact that they have over 160 billion dollars worth of external central government debts due in the next 12 months. The payment of that debt would naturally become more difficult as the currency continues to depreciate.

What’s Next?

The government has been more proactive as the predicament worsened in the beginning of the new year. In late December of last year, the exchange rate went out of control, slumping all the way down to more than 18 lira per U.S. dollar. Though it has continued to eschew orthodox policies regarding interest rates, the government has implemented several stopgap measures, including selling off foreign exchange reserves and protecting deposits in lira from exchange rate variation. These policies have cost the government billions of dollars, as net foreign reserves fell to as low as 7.5 billion dollars before rehabilitation via a mandate for exporters to sell 25% of their forex revenues to the Central Bank and swaps with other nations such as the UAE and Qatar.

These strategies were initially successful in minimizing losses, as the exchange rate was consistently around 13.5 lira to the dollar for the first two months of 2022. However, the recent developments involving Ukraine and Russia have spoiled Erdoğan’s plan. Turkey, connected geographically to the two nations by the Black Sea, is a leading importer of Russian energy and is also heavily reliant on both nations for grain and tourism. The blow to the tourism industry may be especially far-reaching for Turkey; a 34 billion dollar industry is likely to be greatly reduced, further hindering the already slow progress towards a current account surplus. These concerns have led to the lira sliding down to around 14.6 to the dollar.

This economic turmoil has caused severe impacts on the daily lives of ordinary Turks. Citizens were already worrying about prices at the beginning of 2021, when the exchange rate against the dollar was at approximately 7.4. Now, government officials are telling the public to simply eat less. Even tech giants such as Apple briefly stopped selling products in Turkey due to the volatility of the currency. Erdoğan has already experienced a slip in his seemingly unshakeable popularity, with the largest opposition party now in control of Istanbul, Ankara, and Izmir, Turkey’s three most populous cities. Erdoğan’s AK Party can ill afford further voter unhappiness. Erdogan’s response to potential citizen protests and riots will be critical to his continued rule over Turkey.

Take-Home Points

- The Turkish lira has depreciated considerably compared to the dollar in the past year, over 40% while inflation has skyrocketed.

- President Erdoğan follows his own personal views on the basic economics principles of inflation and interest rates. His stubbornness has at the very least exacerbated the exchange rate and inflation crises.

- Actions taken by the government have been complicated by the Ukraine-Russia conflict

- Further unrest may lead to internal political upheaval in Turkey

Everything is very open with a very clear explanation of the challenges. It was definitely informative. Your website is extremely helpful. Thank you for sharing!