Author: Derrick Cui, Graphics: Ria Raniwala

The BRB Bottomline:

Anti-aging is no longer relegated to the figments of our imagination, and financiers are jumping at the chance to fund treatments to extend active lifespans. But is it worth the cash?

The dream of immortality is well documented in human history. Cultures and religions around the world have come to their own interpretations, each unique but equally fascinating — like the fountain of youth, which offers within its flowing waters eternal juvenescence, or an everlasting afterlife promised in certain religions for those who are faithful. The universal fear of death is an innate and powerful human emotion, one that precedes all other feelings and concerns. In the 21st century, however, this fantasy has entranced a new generation of dreamers. This time, they are star-studded scientists found in seemingly unassuming laboratories, challenging the limits of human capability using the newest tech, backed by mountains of private money.

Take Altos Labs, founded by Hal Barron, Hans Bishop, and Richard Klausner — previously the president of R&D at Calico (a biotech subsidiary of Alphabet Inc.), the President of Specialty Medicine at Bayer Healthcare, and the 11th director of the National Cancer Institute of the United States, respectively. Altos staffs some of the most prestigious scientists in the world, including Shinya Yamanaka, the 2012 Nobel Prize winner in Medicine for his research in cellular reprogramming in mammalian cells, and Jennifer A. Doudna, the 2020 Nobel Prize winner in Chemistry for her work developing methods for genome editing. In January 2022, within a month of the startup’s creation, they raised a mind-boggling $3 billion with nothing but a team and vision. In fact, their focus is not on creating commercially viable products that offer a profit engine, but instead on conducting anti-aging research. Their backers include prominent entrepreneurs like Yuri Milner (an early investor of Facebook, Wish, 23andMe, and Planet Labs, among others) and reportedly Jeff Bezos, the founder of Amazon.

The past decade of low-interest rates and globalization has brought together the perfect storm for billionaires, venture capitalists, and traditional healthcare financiers to invest in ideas that take decades to materialize, let alone manifest in a market-ready product. For billionaires like Larry Page and Jeff Bezos, these investments aren’t made with the expectation of monetary profit, but are rather a way to get involved in what could be world-breaking research, and ultimately acquire the one thing they cannot buy — time.

Aging Research

What is Aging?

When hospitals and governments release death statistics, they often credit heart disease, cancer, viruses, and various autoimmune and neurological conditions. Though these may be the ultimate causes of death, aging is the largest risk factor that precedes them. For example, 60-year-olds are 40 times more likely to get cancer than 20-year-olds. Though the idea that older people have a higher likelihood of dying from an illness has been ingrained into common knowledge, it is not universally true: some species, like the Aldabra giant tortoise and lobsters, do not have a higher incidence of illness as they get older. Additionally, experiments on rats have allowed researchers to turn back the clock, making them biologically younger. Anti-aging research aims to remove the weakening of the body due to aging, lowering the danger of illnesses and diseases that traditionally are especially threatening to the elderly.

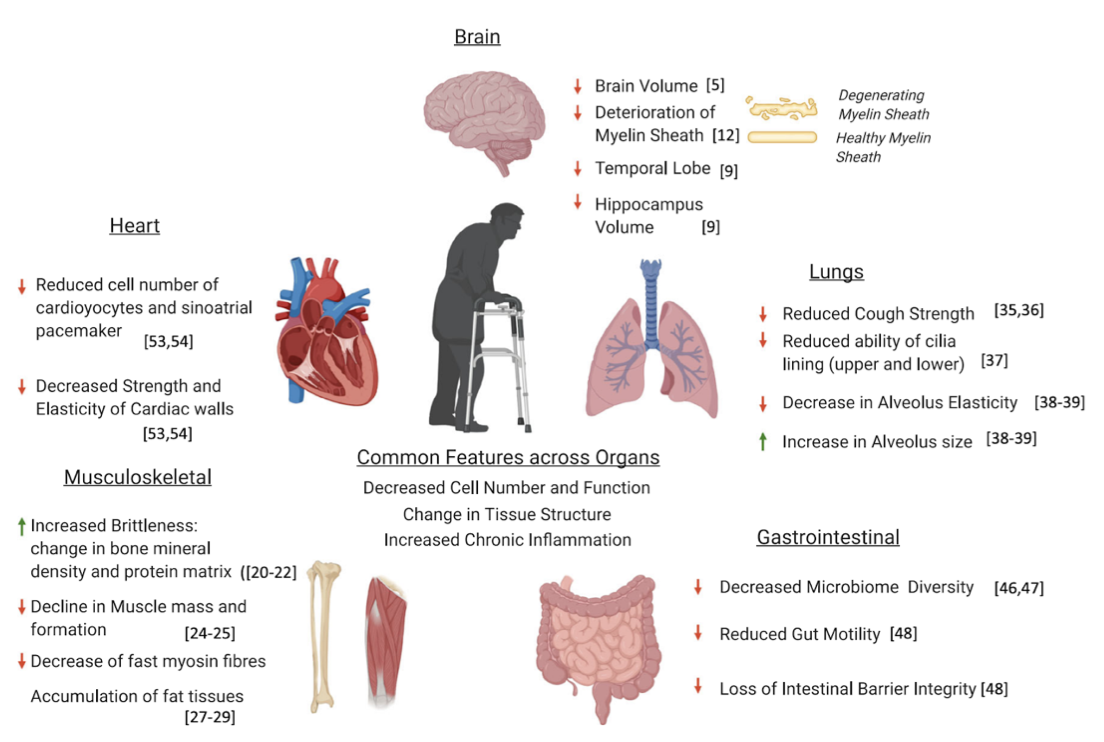

One of the most prominent theories of aging is senescence or biological aging, the idea that the moment after the germ and soma separate, the body programmatically starts to deteriorate. In effect, aging is not a singular biological clock, but an aggregate of every part of the body breaking down and becoming more inefficient. This theory, among others, is backed by empirical evidence, opening the possibility for humans to fix the body as it deteriorates.

Current Progress

Longevity research has had extensive progress in the last decade due to improvements in methodology, better aggregation of research, better funding, and greater interest in the scientific community. Two areas of research that exemplify this trend include senolytics and gene therapy.

Senolytics

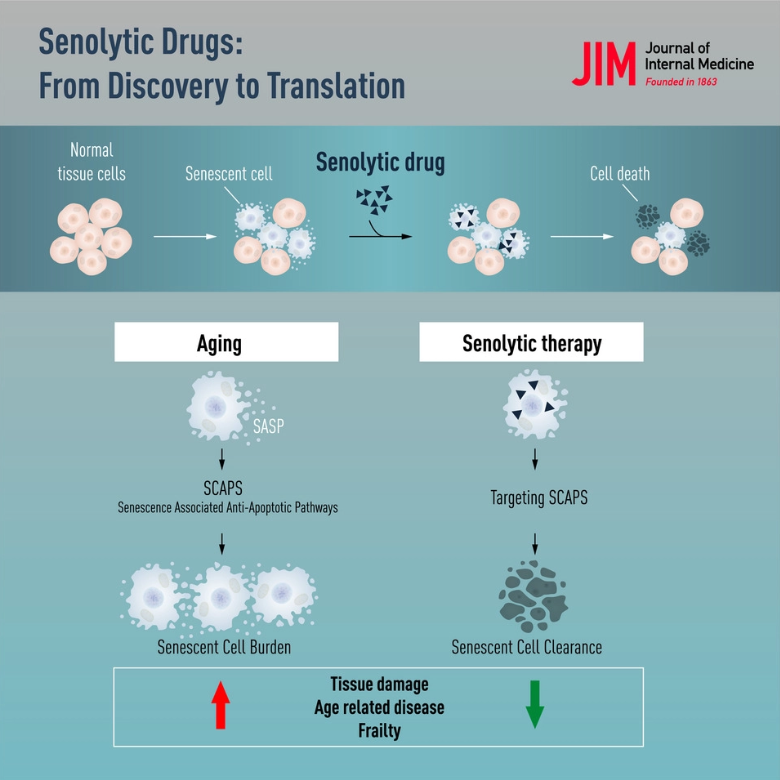

The life cycle of a cell generally ends when they divide or when they self-destruct (apoptosis). However, a small subset of cells can fail to self-destruct and instead stick around, acting like zombies. These “senescent” cells stay in place, emitting inflammatory signals that degrade nearby tissue and raise the risk of cancer. In essence, senolytics work by targeting some of the ways these senescent cells used to survive.

There are dozens of companies working on different senolytics. A leader is Unity Biotechnology, a biotech company based in San Francisco, funded by $200 million in venture capital and another $85 million from its IPO. Initial backers include the Longevity Fund (run by Laura Deming, named in the Forbes 30 Under 30), Jeff Bezos Expeditions, Founders Fund (a partner of which is Peter Thiel, founder of PayPal, Palantir, who is worth an estimated $7.19 billion), and ARCH Venture Partners (a partner of which is Robert Nelson, estimated to be worth $1.72 billion).

Founded in 2011, Unity experimented with many different cures for various senolytic treatments before finally focusing on UBX1325, an inhibitor to eliminate senescent cells in age-related eye diseases. Unity initially had hundreds of employees working on multiple solutions for different problems, but after a lack of results in UBX0101, another drug candidate meant to treat osteoarthritis, they now stand at only 34 full-time employees. Though a gloomy reality for Unity, its initial failures nonetheless show that investors are very willing to throw money at young companies to experiment in this under-researched field.

Dozens of other senolytic companies are focusing on drastically different methods. Recursion, a company based in Salt Lake City, uses automation and machine learning to revolutionize drug discovery, significantly cutting down the time required to find drug candidates and reducing the risk of producing an ineffective or useless drug. With dozens of products in the pipeline, like a Neurofibromatosis Type 2 disease drug currently undergoing drug trials, Recursion aims to improve the quality of life for those with degenerative diseases (which slowly manifest over time during natural aging), and especially for individuals with genetic mutations that subject them to expedited degeneration. Being founded in 2013 and having raised over $450 million cumulatively through several streams of funding, Recursion is currently valued at over $1.9 billion.

Gene Therapy

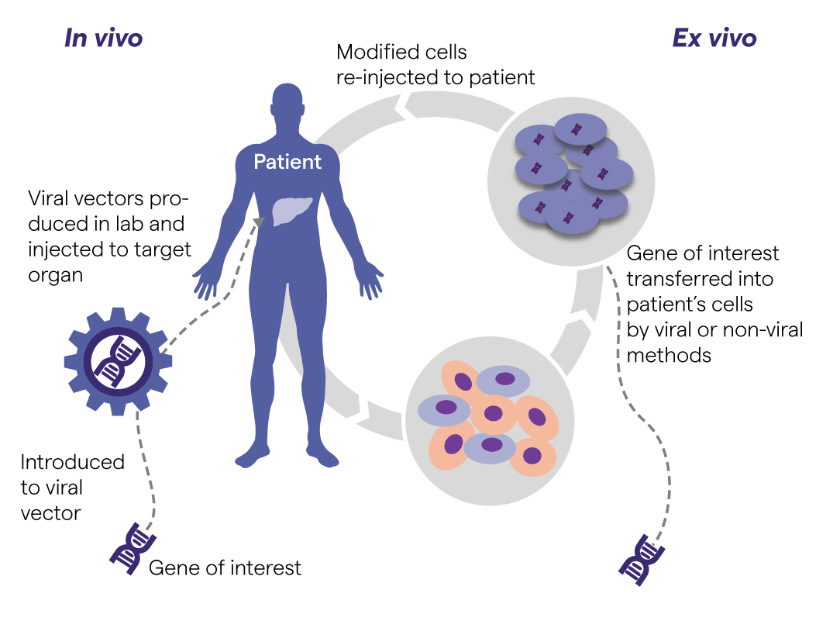

Gene therapy in the context of longevity aims to “reprogram” cells in the body so that aging no longer creates or causes cellular degradation. Generally, it consists of changing the DNA of cells so that damaged parts are removed or replaced with a non-degrading DNA segment.

After a boom in research and technology, hundreds of companies are now currently working on new gene therapies. Previously, scientists believed that genes were interdependent, where the change of one gene initiated a cascading effect that made it difficult to identify specific behaviors. However, scientists realized that singular genes do, in fact, have discrete impacts, like the GATA6 gene that regulates the aging of human mesenchymal stromal cells (MSCs). Combining this understanding with improvements in vector development (capsules to inject DNA) and new tools like CRISPR has led to profound growth in this field.

For example, founded in 2017, Rejuvenate Bio aims to insert genes to fight specific illnesses. The product furthest along in the pipeline is RJB-01, which targets the FGF21 and TGFβ-1 genes to increase insulin sensitivity and suppress fibrosis and other cancers, creating a treatment for both weight loss and diabetes while also inhibiting tumor growth. They have raised a cumulative $17 million in funding with fewer than 50 employees.

An example of a founder who has gone to more extreme lengths is Elizabeth Parrish, the CEO of BioViva, who self-injected four therapies of telomerase reverse transcriptase (TERT) intending to increase the caps of chromosomes called telomeres which shorten in length as cells replicate. She represents a new generation of biohackers who believe in self-testing and the possibility of using personalized genetic engineering to solve aging. BioViva currently focuses on the research and development for heart disease, dementia, and type 2 diabetes, with the lofty mission of “working on giving you more time to do the things you want to do.”

A Taste of Money

Long-term and tech-focused funds like Cathie Wood’s ARK Invest fund treat biotech companies as they do traditional tech companies, with the same money-first, results-second attitude. The ARKG ETF, or Genomic Revolution ETF, holds equity shares of big pharma companies like Ionis Pharmaceuticals Inc. as well as those of known innovators like CRISPR Therapeutics. Traditional big-player investors have poured money into biotech, with some of it going into anti-aging research. Some companies have even doubled down. Korify Capital recently announced a $100 million fund named Korify Capital One that focuses on funding startups working towards longevity. The Longevity Science Foundation based in Switzerland recently announced that they will spend $1 billion over ten years solely for longevity research with the goal of “extending the healthy human lifespan to more than 120 years.” In addition, German billionaire Michael Greve, founder of Forever Healthy, committed €300 million last year to rejuvenation startups.

It is difficult to measure how much money is going into longevity tech because of how porous it is with traditional biotech investment. For example, innovation and investment in CRISPR Therapeutics, a $3.96 billion giant, advances how AI, automation, and CRISPR are used in general gene therapies, benefiting all other companies who aim to use that tech in their longevity research. On top of that, non-profit organizations like the Buck Institute have popped up with the explicit mission of ending the threat of age-related disease.

Money on My Mind

It seems that even in a bearish economy, there is still more money chasing innovation driven by limited, bright minds. Perhaps that might not come as a surprise. There are hundreds of different parts of aging that need to be better understood, and every few weeks, a discovery revolutionizes various fields of research and methodologies. From amyloids and adducts to parabiosis and prebiotics, every piece of the puzzle can use a deeper, more complete understanding.

Furthermore, perhaps investors know that if the treatments they are blindly funding come to fruition, it will bring them considerable returns because people spend a lot of money delaying death and buying more time. All we can do in the present is speculate. No one knows what treatments will work, let alone make it past clinical trials. And yet, the scientific community is steeped in optimism. It seems that to investors, longevity is the future, no matter how much it costs and how far away results seem to be. Perhaps, if the arduous trek to the fountain of youth requires only human ingenuity and money, we should not be worried about if, but when we will get there.

Inspired by Ageless: The New Science of Getting Older Without Getting Old by Andrew Steele

Take-Home Points

- Longevity research has exploded this century, backed by state-of-the-art tech and mountains of private money.

- Aging is the largest risk factor that precedes all illnesses.

- Aging research is broad and splits into three categories: extending active lifespans, slowing the process of aging, and reversing aging.

- Investors are very willing to throw money at young companies to experiment in such an unknown field.

- There are hundreds of companies working on therapies after booms in research and technology.

- Long-term and tech-focused funds like Cathie Wood’s ARK Invest fund group biotech with traditional tech.

- It is difficult to measure how much money is going into longevity tech because of how porous it is with traditional biotech investment.

- It seems that even in a bearish economy, there is still more money chasing limited bright minds.

- Investors continue investing, perhaps because they have realized: what is the point in dreaming of the fountain of youth when it seems just a few decades and a couple of hundred billion dollars away?

A dense and incredibly nuanced read on the extensive research and funding needed to essentially unlock time. The average human life span is only going to get bigger from here on out!

Food for thought! This clearly shows the leisurely boredom of the billionaire class and where they want to be in the near future! If said technology were to become available, how do you think it would be distributed?

Insightful read.

Wow! It is difficult to conceptualize how much is left to experiment in such an unknown field. I am curious to see the impact of investments and hope to learn more about “aging research” in the future!

Very interesting article, especially the possible implications of the human race expanding the expiration of lifetimes such as potentially contributing to overpopulation and further hoarding of resources.

It’s interesting to see how scientific progress is making the idea of “the foundation of youth” a reality. Reversing aging, especially, makes me question how longer lifespans will impact our society.

I’ve never thought about longevity research as a business. The amount of investment these types of corporations are receiving is incredible and very interesting.

Anti-aging and any similar topics have remained a cash grab for years! This article underscores the research and its intensive financial breakdown. Really insightful perspective.

Wow, very thorough analysis and information on genetics and how it can help turn back the clock. Very interesting to see the business side of aging research and how many investors it takes.

Wow, great read! It’s really interesting to see how anti-aging research interacts with the finance and investment world. I’m curious to see how this develops throughout our lifetimes and whether it will become a point of profit for businessmen.

An extensive and well thought out article, with detailed insights on the resources needed to further longevity. Perhaps, bringing such significant ideas to fruition necessitates a public-private effort?

Very interesting article – it definitely puts things into perspective when you hear people talk about 120-year lifespans being a real possibility in the future.