BRB Bottomline: How do you plan to pay for school? Are federal student loans able to assist you in your quest for higher education? Hang on tight as we deconstruct federal student loan options and see how they can help you afford college!

It’s the middle of October, and millions of seniors in high school are drafting application essays for their chance to attend the college of their dreams. One of the biggest considerations for applicants is financial in nature. It’s no surprise that pursuing higher education can be monetarily taxing. Often times, college can cost students tens of thousands of dollars each year. In order to afford tuition and living expenses, students often turn to scholarships and non-gift financial aid in the form federal loans.

The Basics of Student Loans

According to Investopedia, a loan is money given to another party in exchange for future repayment of the borrowed amount. The federal government represents the largest lender of student loans in the U.S., which helps students pay for expenses like tuition, room and board. Nearly 70% of students pursuing a bachelor’s degree borrow money to pay for college, and the average graduate is more than $29,000 in debt. Federal student loans can be of great help to students who are looking to pursue a college degree while at the same time, are a huge financial investment and caution should be exercised when deciding how and when to borrow money.

Note: Two terms that are used frequently when describing federal student loans are ‘subsidized’ and ‘unsubsidized’. In this context, subsidized loans are loans that do not collect interest as while you are in school. Unsubsidized loans are loans that collect interest while you are in school. Keep this in mind as you read on!

Private vs Federal Loans

Student loans come in two flavors: private and federal. The main difference is the means at which you apply and receive the loan. To an extent, the profit motive differs between private and public players, however, you’ll find that federal loans have nicer terms—lower interest rates and longer maturities. On the other hand, private loans are more expensive and have higher credit standards. Federal loans are given to individuals with the purpose of helping them afford college, while private loan providers hike interest rates in a more predatory fashion. As we don’t recommend that you go the private loan route unless absolutely necessary, the rest of this article will focus on federal student loans.

Understanding Federal Loans

Federal student loans are loans serviced by the federal government. In order to receive any federal assistance in the form of grants or loans, you have to submit a FAFSA (Free Application for Federal Student Aid) form. A link to the form is here. The ultimate purpose of the form is to calculate a student’s Estimated Family Contribution (EFC) from the financial information that you provided (and your family provided, if applicable). To figure out how much financial aid to give students, the financial aid office of your university will subtract the EFC from the total cost of attendance to calculate how much your family will get in aid.

Once a FAFSA form is submitted and reviewed, the university will offer you a loan and gift aid package that should get you most of the way of there. You may not have heard of gift aid before. Gift aid is money provided by the university that does not need to be repaid by the recipient, which includes scholarships and grants. In addition to gift aid, the university will offer a loan (or several loans) to make up the difference. Of course, you could pay the remainder with the extra cash that you or your parents have saved; however, most people are unable to due to the sheer cost. There are a few types of loans that universities award to students, and each variety has its benefits and drawbacks. If the college doesn’t offer you the type of loan that you want, you can try to contact the financial aid office.

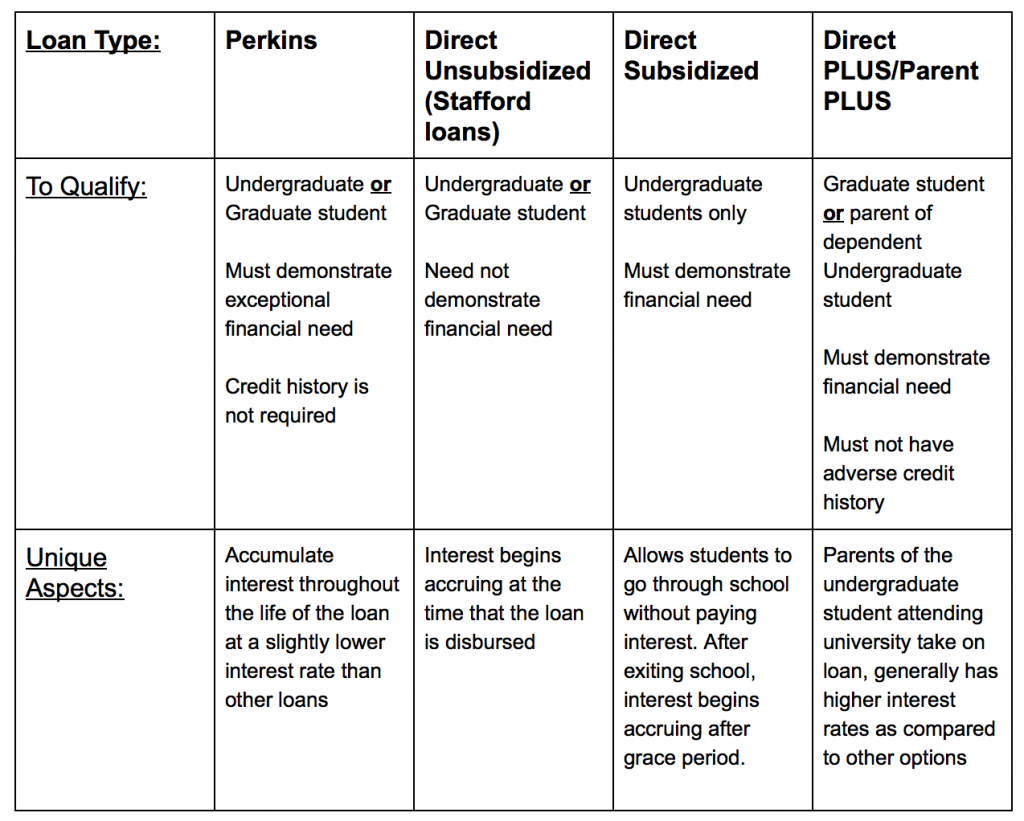

Types of loans include: Perkins loans, Direct PLUS loans, Direct Subsidized loans, and Direct Unsubsidized loans.

Repayment

After your time at college, you’ll not only owe the principal amount of the student loans that you took out but also the interest that has collected over those four years (assuming you took out an unsubsidized loan). Most loans offer a ‘grace’ period – a six month period after graduating for which you need not begin making payments. This is especially useful when searching for a job, and gives you the time to collect the funds you’ll need for that initial payment.

The first step in starting the repayment process is to select a repayment plan. Each plan is unique to the financial situation of the student, and can be calculated using this helpful estimator provided by the federal student loan website.

In order to make a payment, you have to contact your loan service provider. Each provider has a different collection practice, which depends on the student’s financial situation and the type of loan. For more information on payments or the overall repayment process, visit the repayment page on the Federal Student Aid site.

Take Home Points

Most students will take out some type of student loan—public or private, subsidized or unsubsidized—and it’s important for students to have an understanding of the financial options available to them to pursue a college education. By planning ahead, students should be able to select the correct financing options for their situation and not get tricked by greedy lenders. In addition, remember to fill out your FAFSA. Filling out the FAFSA is necessary to receive federal student aid, which opens up countless opportunities for students to finance their college education. Even if they don’t end up choosing to take out a loan, it is nice to know what options are available.

Thanks for another informative blog. Where else could I get that kind of info written in such an ideal way? I have a project that I’m just now working on, and I have been on the look out for such information.

I don抰 even know the way I ended up right here, but I assumed this put up used to be great. I do not recognize who you’re but definitely you are going to a famous blogger in the event you aren’t already 😉 Cheers!