Author: Cindy Xue, Graphics: Business Review at Berkeley

For college students, A stable nine-to-five is not a viable option for finding financial freedom. With busy schedules and digital opportunities, young people are discovering and shifting towards passive income streams.

Passive Income 101

Imagine making money in your sleep and waking up to a hefty sum in your bank account. This money is not a result of extra hours of tiring work at a part-time job; instead, it’s all part of having your money work for you as passive income.

With active income, which is essentially the money you earn from directly engaging in work, students trade time and labor for money. Active income that can earn a living wage typically refers to nine-to-five jobs with paid salaries or hourly pay.

Passive income, however, is any money an individual earns that does not require active earning. Differing from the traditional income streams that are earned as a reward for efficiency and longer working hours, passive income builds stores of value that don’t require active participation.

Why Take Advantage of It As a College Student?

Saving Time

“Time is Money” is a classic saying heard in the corporate world. For college students, time is especially precious. From balancing classes, clubs, a social life, and sleep, adding a job on top of it all is a daunting prospect. For students, passive income money works around the clock without constant surveillance, freeing up more time to spend on enjoying the college experience.

As a college student, my day is packed with classes, club meetings, study sessions, and group hangouts, leaving no room whatsoever for a part-time job. Days are already tiring and stressful enough, and I feel an overwhelming pressure to maintain good grades yet also have the best time of my life. With all this added stress, building up passive income streams serves as the perfect solution for making some money without having to sacrifice my grades, sleep, or social life.

Financial Freedom

Another benefit of passive income is that it builds wealth incrementally. Financial Freedom is another term used in finance discourse that often eludes a concrete definition. According to Mercer, financial freedom is when “You have a sufficient financial cushion in the form of savings and investments to cover all your living expenses and other financial goals.” Aside from being a term found in a lot of New Year’s Resolutions as people age, financial freedom can refer to anything from having enough money to retire to being able to start a business.

According to Investopedia, “Only 11% of respondents in a survey conducted by digital personal finance firm (Achieve) said they are living their definition of financial freedom.” Contrary to popular belief, only 12.6% of respondents in the survey consider being rich as having financial freedom. Instead, the main types of financial freedom commonly referenced include being debt-free, living comfortably, and meeting monthly financial obligations. For students especially, financial freedom means paying off student loans and preventing student debt.

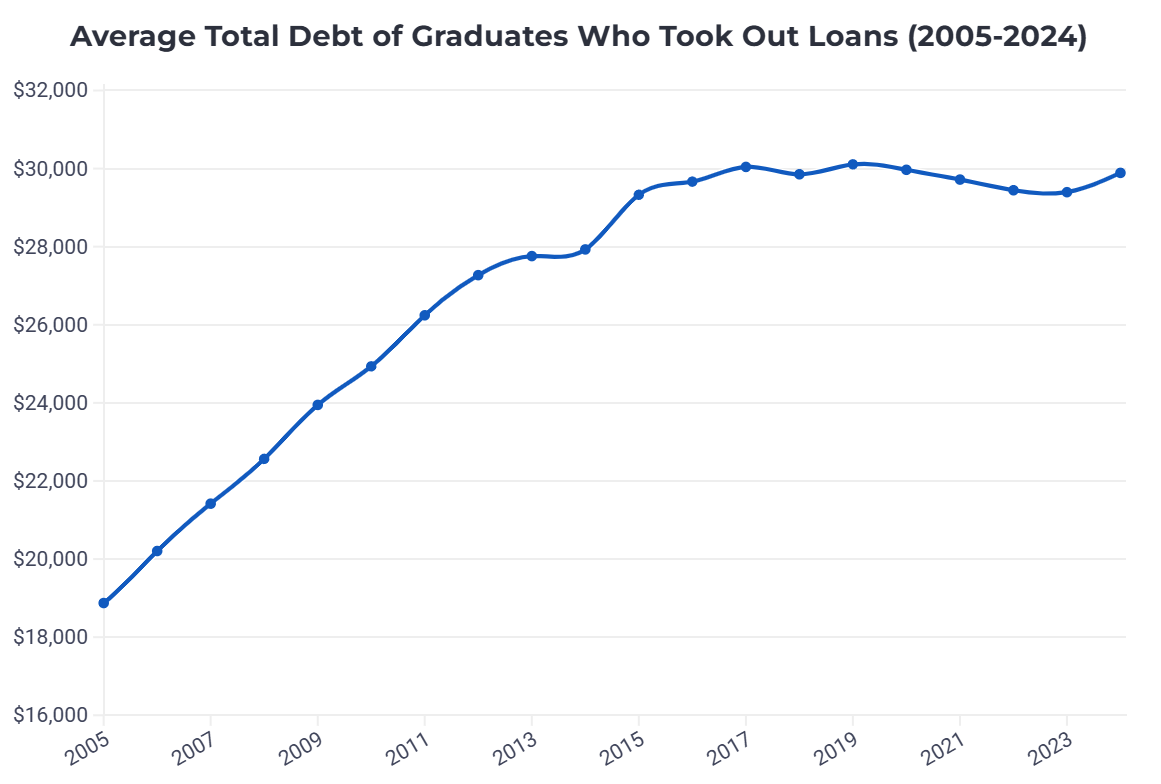

According to the chart above from US News, the average total debt of graduates who took out loans in recent years has clearly increased since 2005 with an average debt of $29,890 as of 2024. Student debt is the biggest financial issue facing college students to date, which is why you should start early to combat this issue by building up passive income streams.

Income Diversification

Furthermore, passive income is greatly beneficial because it supports income diversification. From investing in the stock market to online businesses, passive income is all about opening up multiple revenue streams, allowing individuals to stop relying on a single source of income. Income diversification is quintessential in your path toward financial security. By diversifying your income, not only do you gain the benefits of having multiple revenue streams, but you are simultaneously taking a less risky approach than relying on a single income stream.

Having your income spread across multiple industries can also serve as a safety net for whenever one or more markets crash. In this day and age with the increasing inflation rates, passive income sources such as real estate provide stable forms of income that are immune to inflation.

Compound Growth

Another advantage of passive income is that passive income streams benefit from compound growth, which is the process of earning returns on both the original investment amount along with returns and interest. One popular passive income stream is dividend reinvesting, where any dividends (payments that a company gives to shareholders) someone earns from their stock investments are automatically used to buy more shares of the same stocks.

Another popular process is compounding interest, which is a seemingly unreal process in which money grows completely on its own. Compounding interest is like growing your own money tree: you put in $1 initially, and in the first year it grows another $1, making a total of $2. The next year, it now yields $2 because the tree is working with what is already there. The tree just keeps growing more and more money every year, since the money keeps expanding on top of itself. Again, money is working for you, rather than you having to work for money. Through compound growth, earnings get reinvested into a cycle as time passes, and you increase your income by relying on compounding your passive income streams.

Unexpected Expenses and Emergencies

One more thing we can’t forget when mentioning the benefits of passive income is the protection it provides against unexpected expenses. Unexpected expenses are a part of daily life. You can be hit with unforeseen circumstances such as sudden medical bills and car breakdowns that can cause a significant blow to your bank account. Having consistent passive income streams can come into play as the perfect financial buffer to help cover unanticipated costs and emergencies without having to use emergency savings or go into debt. Relying too much on credit cards and loans leads to debts of higher interest, and passive income helps combat this by offering ongoing funds.

Credit debt is an especially big issue in the United States as the average American has $6,218 in credit card debt. According to the graph above from the Federal Reserve Bank of New York, the total credit card debt in the U.S. has skyrocketed over the years to a hefty total of $1.12 trillion. Additionally, for college students in particular, there are many hidden costs that tuition doesn’t cover.

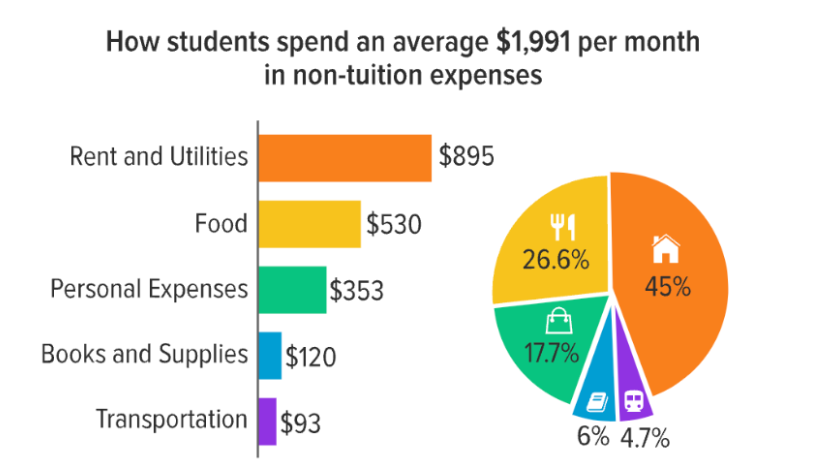

As seen in the graph above, students are met with almost $2,000 in non-tuition expenses. Spending on the necessities listed above such as rent and utilities, food, school supplies, and transportation all add up over time, often accumulating student debt.

How Can You Start Making Passive Income?

Investing in Stocks

As mentioned earlier, dividend-paying stocks can provide you with a stable income stream. Dividends are the percentage of a company’s earnings that is paid to its shareholders as their share of the profits. Dividends are typically paid on a regular schedule established by the specific company, so they can be paid monthly, quarterly, or annually. Essentially, when you invest in a dividend-paying stock, you own a tiny piece of a business that will share a bit of its money with you on an established regular basis. You are being rewarded for being a part of the company, just like the coupons and sales you get when signing up to be a rewards member for a retail store like Target or Sephora.

Aside from dividend-paying stocks, investing in an index fund is another great way to make money passively. An index fund is a collection of stocks that essentially gives you a little piece of everything in an entire market, which makes it much less risky than investing in individual stocks. As the companies within the index grow, their stock prices will increase. The value of the money you initially invested into the fund increases, which means your investment itself also grows. Investing in index funds is an excellent option for letting your money gradually grow in the background.

Selling Digital Products

In addition to the typical stock investing path, selling digital products including prints, e-courses, templates, and resources is especially ideal for making passive income; once they are created, these digital products can keep generating sales with minimal effort.

In contrast to physical products, digital goods only need to be produced once, and can then be sold an unlimited number of times. For instance, if you were to sell a digital planner template, you only have to create it once, and then you can keep selling copies of the template as much as you want.

Passive Income Through YouTube: Insights from Minecraft Youtuber Kory

Content creation has become more popular than ever. With the growing use of technology, people rely more and more on their phones and laptops, making content creation the next big thing. Additionally, once you upload content onto the internet, it stays there forever, and it can keep growing money for you without you ever having to lift a finger.

The biggest money-making platform is undeniably YouTube. YouTube supports content monetization and pays its creators per ad-view, which has allowed many people to rely on YouTube as a primary income stream.

In an interview with famous Minecraft YouTuber Kory, he describes how YouTube has become a reliable source of income for him. He mentions that “finding your niche is incredibly important, especially regarding ads and sponsorships from big companies”, as this is the primary way YouTubers earn their income.

First Steps Towards Earning Passive Income on Youtube

For starters, Kory recommends for aspiring YouTubers who are looking to utilize YouTube as an income stream to “find a niche category that has good money for value”, especially since financial returns vary significantly based on your target market and industry. He mentions in particular that if you are aiming for greater financial returns, he would advise starting a financial channel.

Kory explains, “Financial channels make a lot more than gaming channels because advertisers would pay more money to reach those older audiences, while gaming channels on the other hand wouldn’t garner bigger companies because an audience of kids isn’t that relevant to their company.”

Creating Content That Engages Viewers

Further, after finding a niche, Kory emphasizes the importance of creating content that is attention-grabbing and engaging. “There are two incredibly important components to a YouTube video: click-through rate (CTR) and average view duration (ABD),” Kory outlines. CTR helps to measure the effectiveness of thumbnails and bold titles, while ABD measures how long people stay engaged with specific videos. Tying CTR and ABD back into the money-making aspect, Kory summarizes everything in simple words, stating “The more views and watch time you get, the more ads play, which makes more money.”

Building a Brand

Beyond purely relying on ad revenue, one thing Kory especially likes about YouTube is that the platform allows him to build up a brand for himself, allowing him to expand into other sources of income as he further emphasizes that “creating a brand for yourself is the greatest thing you can do” since you can then build further revenue streams like merchandise, products, and affiliate marketing (an advertising model where a company compensates people to generate traffic towards the company’s services).

As you explore these different streams of passive income, keep in mind that nothing happens overnight. Taking the first steps toward financial freedom is what matters, as you can then let your income grow on the sidelines. Take the initiative to start now, and as time passes, your future of financial freedom will get closer and closer.

Take-Home Points

- Passive income is the perfect way to generate money through minimal effort, which is incredibly ideal for busy college students.

- Passive income saves time, leads to financial freedom, and helps protect you from unexpected expenses and emergencies.

- Income diversification through different passive income streams helps to reduce the risk of relying solely on one stream of income.

- Compounding helps to grow passive income, helping to increase earnings as time passes.

- Some great passive income options for college students are investing in stocks, selling digital products, and content creation, especially through YouTube.